Auto Care Mailbag – Regional Aspects of Aftermarket

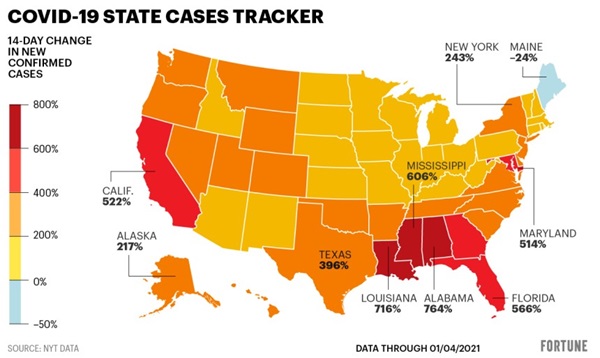

Here at Auto Care, we get a variety of inquiries on trends and the industry. One question came up recently: “With Omicron spreading, how much will that impact our industry, especially in the south?”

Great question! It’s hard to believe that we’re approaching “Year 3” of COVID-19. The chart below shows the relative change in confirmed COVID-19 cases by state:

Source: Fortune, Jan. 5, 2021

With the rise in cases throwing a wrench in school and office operations, it seems reasonable to conclude that a return to virtual work/school is more likely in areas with higher incidence, assuming similar response regarding activity restrictions as the past two years. Could an increase in remote work/school lead to reduced Vehicle Miles Traveled (VMT) and less automotive spend?

As we have seen, the automotive aftermarket has exceeded expectations throughout the pandemic. Let’s take a look at the data our members have access to via the interactive data platform, TrendLensTM, to unpack this question.

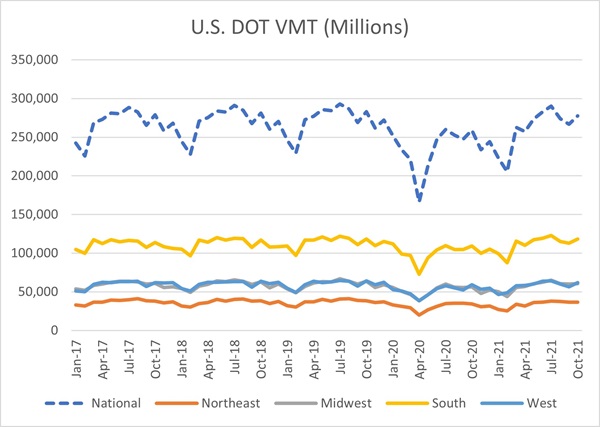

South is the Regional Vehicle Miles Traveled (VMT) Leader

The South has historically led VMT relative to other regions:

How’d You Do That?

The Market View package in TrendLensTM now allows users to look at regional U.S. DOT VMT data along with a suite of economic and industry indicators for just $1,200/year: average temperature, average temperature deviation, diesel fuel and gasoline prices and sales, housing starts, new and used vehicle consumer prices (indexed), and unemployment.

Additionally, the Market View package allows users to view Arity weekly VMT, and to download all indicator data into Excel for further analysis. Interested? Click here to learn more.

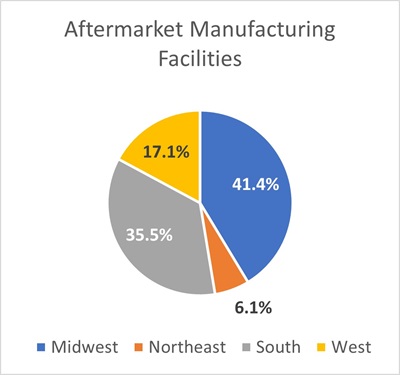

One-Third of Aftermarket Manufacturing Facilities are in the South

When thinking about the impact of Omicron to the aftermarket, let’s think about the facilities. In each edition of the Factbook, we list the number of manufacturing facilities for selected NAICS codes by state. Here’s how they break out by region:

- Midwest: 41.1%

- South: 35.5%

- West: 17.1%

- Northeast: 6.1%

Through 2Q2021. Source: Bureau of Labor Statistics [NAICS codes 326211 (Tire mfg except retreading), 33631 (Motor vehicle (MV) gasoline engine and parts mfg), 33632 (electric equipment mfg), 336330 (MV steering and suspension parts), 336340 (MV brake system mfg); 336350 (MV power train components mfg), 336360 (MV seating and interior trim mfg), 336370 (MV metal stamping), and 339390 (Other vehicle parts mfg)]

Verdict? The South has a significant proportion of aftermarket manufacturing facilities, so COVID-related closures will directly affect this part of the country, and all aspects of the supply chain nationwide.

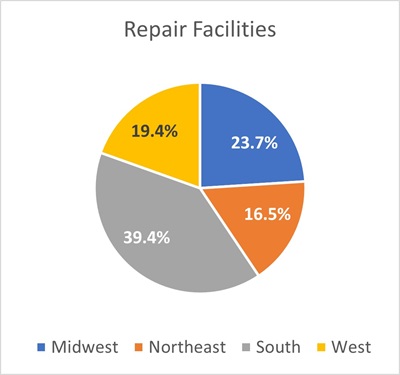

Plurality of Repair Facilities are in South

The South leads in the proportion of repair facilities:

- South: 39.4%

- Midwest: 23.7%

- West: 19.4%

- Northeast: 16.5%

Through 2Q2021. Source: Bureau of Labor Statistics [NAICS codes 423120 (New motor vehicle parts merchant wholesalers), 423130 (Tire and tube merchant wholesalers), 447110 (Gasoline stations with convenience stores), 447190 (Other gasoline stations), 811111 (General automotive repair), 811112 (Auto exhaust system repair), NAICS 811113 (Auto transmission repair), 811121 (Auto body and interior repair), 811191 (Auto oil change and lubrication shops)]

Similarly, activity restrictions due to the pandemic will disproportionately affect the South as VMT would decrease. This implies continued agility and adaptation by service providers as I expect that vehicle owners would continue to care for their vehicles as their driving patterns evolve, much as we saw throughout the past year.

Change Never Stops

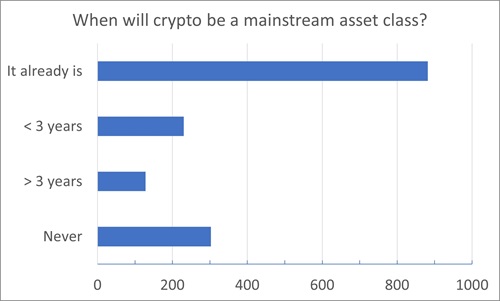

One last thought – I am a pretty conservative investor – indexed based mutual funds, large cap stocks, age-based retirement funds … no cryptocurrency! Yet, crypto is already viewed as a mainstream asset class, at least according to an informal poll I took last week while attending a webinar

Source: Survey taken Jan. 6, 2022 on BrightTALK platform

While this currently has nothing to do with the automotive aftermarket as we know it, with the world changing (Elon Musk once said that Bitcoin is an acceptable form of payment for a Tesla automobile, but did walk this back), this could change.

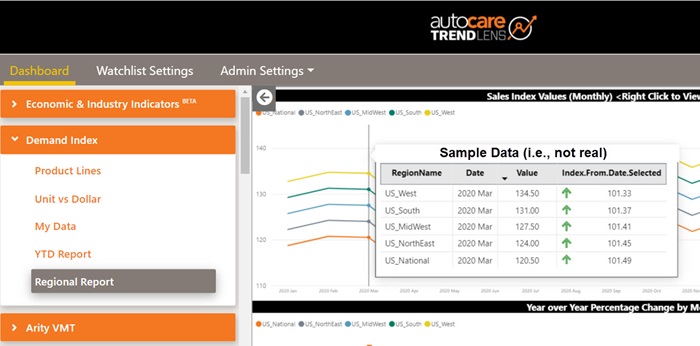

Source: TrendLensTM

Source: TrendLensTM

Regional Point of Sale Data Now Available

Subscribers to Demand Index can now access regional point of sale data for their product lines as pictured to the left.

Adding the Market View for an even more compelling bank of data – imagine comparing regional sales data to regional VMT data – that is now possible. Interested in learning more? Click here to contact us to see how this works.

Michael Chung, Director, Market Intelligence

Ready to dive into market research? I provide the industry with timely information on key factors and trends influencing the health of the automotive aftermarket and serving as a critical resource by helping businesses throughout the supply chain to make better business decisions. More About Me

Market Insights with Mike is a series presented by the Auto Care Association's Director of Market Intelligence, Mike Chung, that is dedicated to analyzing market-influencing trends as they happen and their potential effects on your business and the auto care industry.

More posts

Content

-

[WATCH] Driver Behavior Trends and Their Impact on Parts and Service Opportunities

March 17, 2022This webinar analyzes driving behavior at the national, state, and local levels. Gain insights into: consumer behavior; driving patterns; and potential impacts on parts replacement, service and repair scheduling, vehicle age, and the car parc.

-

[WATCH] 2022 Business Outlook: Top Emerging Opportunities and Challenges

February 4, 2022This webinar explores need-to-know emerging opportunities and challenges for the coming year: current status of supply chain issues and what to expect in the year ahead and more.

-

[WATCH] How to Use Vehicle Miles Traveled to Better Your Bottom Line in 2022

December 3, 2021Vehicle Miles Traveled has been respected for years as a key indicator of aftermarket opportunities. Historically, planning has been limited to directional indicators but now aftermarket businesses can leverage more detailed insights on geographic differences as well as vehicle differences to more effectively take advantage of aftermarket opportunities.