“Finishing the Fight” Amidst Continued Uncertainty of COVID

About a year ago, the Metro DC area became enraptured with the Washington Nationals’ rise from seeming doom earlier in the season. “Finish the Fight” became the rally cry across the DMV.

I’m seeing the same “pull yourself up” determination and adaptation throughout the automotive aftermarket and I’m loving it. Despite the ongoing uncertainty of the economy, the aftermarket continues to be resilient and adaptive to constant change. In this issue, we highlight some seasonal sales observations, how shop owners are working with their contacts in the distribution system to fulfill end customer needs, and updated results from our COVID-19 impact survey (click here to take it).

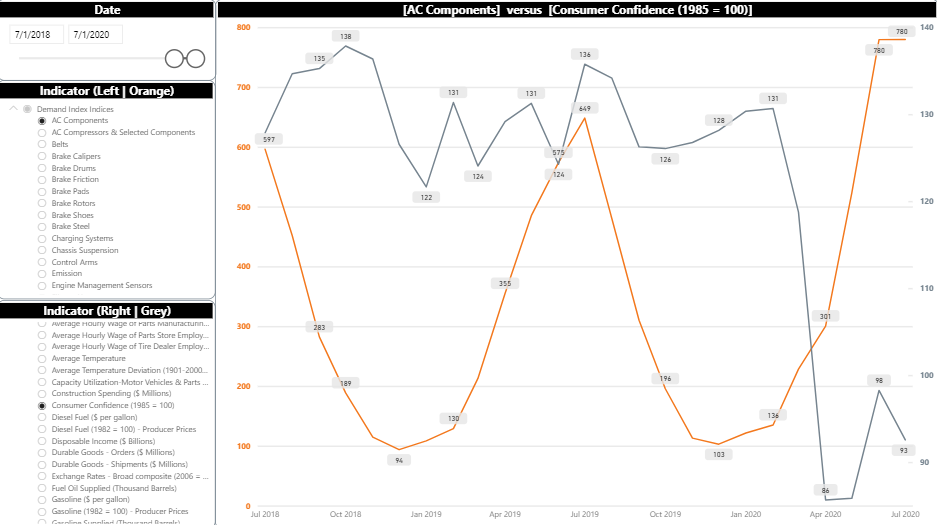

Seasonality of some parts continues, no matter the economy. In the chart below, we look at unit sales of AC parts (orange) from July 2018 through July 2020 (data are indexed to January 2016) alongside consumer confidence (gray)

Source:

TrendLens. Unit sales of AC Components vs. Consumer Confidence, July 1, 2018 -

July 1, 2020.

Source:

TrendLens. Unit sales of AC Components vs. Consumer Confidence, July 1, 2018 -

July 1, 2020.

Despite the significant drop in consumer confidence in March/April 2020, the sale of AC components followed its typical seasonal trajectory, with July 2020 sales increasing on a year-over-year basis.

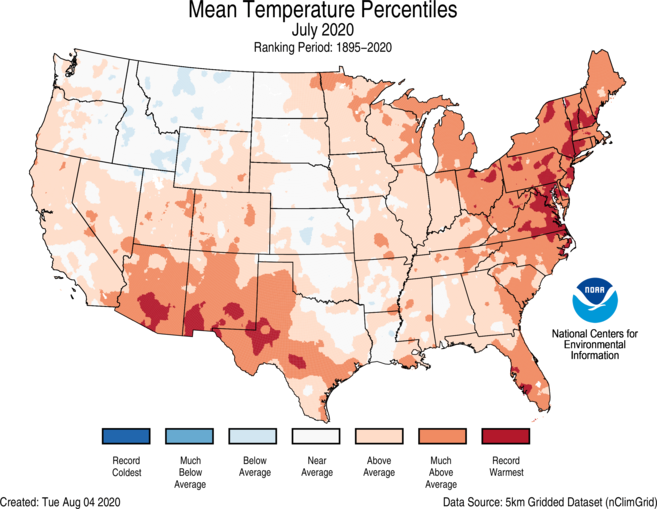

Repair shop owners confirm that even though consumers are driving less, they are continuing to maintain their vehicles, including keeping their AC working throughout a summer of “hotter than normal temperatures”.

Source: National Climate Report – July 2020, NOAA, National Centers for

Environmental Information, https://www.ncdc.noaa.gov/sotc/national/202007; see also: https://www.nytimes.com/2020/06/18/climate/summer-weather-prediction.html

Source: National Climate Report – July 2020, NOAA, National Centers for

Environmental Information, https://www.ncdc.noaa.gov/sotc/national/202007; see also: https://www.nytimes.com/2020/06/18/climate/summer-weather-prediction.html

Andrew Dremak of Mechanic Advisor (provider of marketing communication platforms for auto repair shops) confirmed the trend: “Across the country, the warm summer weather has led to a strong July for many independent repair shops, particularly for A/C service. As consumers resumed driving and getting their vehicles ready for road trips, shops marketed and promoted A/C service campaigns – notably via email and text – to encourage customers to make sure their A/C systems are working correctly.”

Dremak observes this to be particularly true for independent shops since used car sales are higher. Mechanic Advisor has also seen independent shops in resort areas having stronger business with their “summer” residents as they have stayed in their second / resort homes longer than this year. Uncertainty for the fall season does exist, particularly as back-to-school / back-to-office plans continues to be fluid across different states and regions.

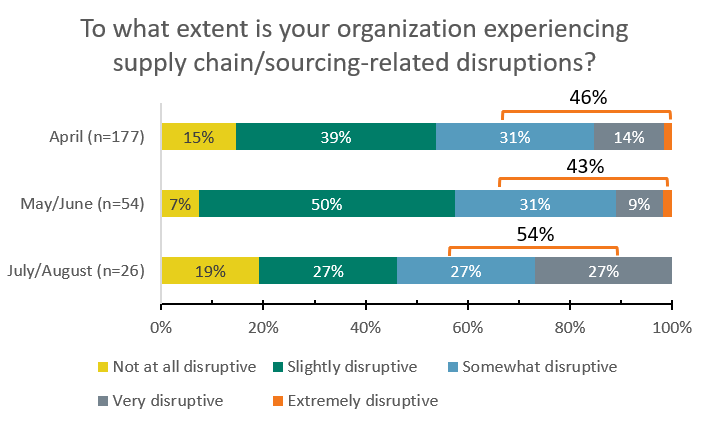

And while shops pivot around seasonal demand and reduced driving habits, they have been adjusting to fluctuations in demand as appropriate. Supply chain continues to be a concern, with a slight increase to 54% in July/August:

Inventory management has been somewhat iterative – Dwayne Myers, CEO of Dynamic Automotive, an independent automotive repair business with four locations in Frederick, MD shared, “The aftermarket supply chain has been doing an excellent job. Store inventories are a little lower right now – for example, before the pandemic, a distributor may have had three or four sets of brake pads, but now only has one. Communication with suppliers and maintaining those relationships continues to be important so that we can set and manage our retail customers’ expectations, and take good care of them in the process.”

Click here to learn more about how Dwayne and three other shop owners have been navigating the current environment in a webinar we held on August 19.

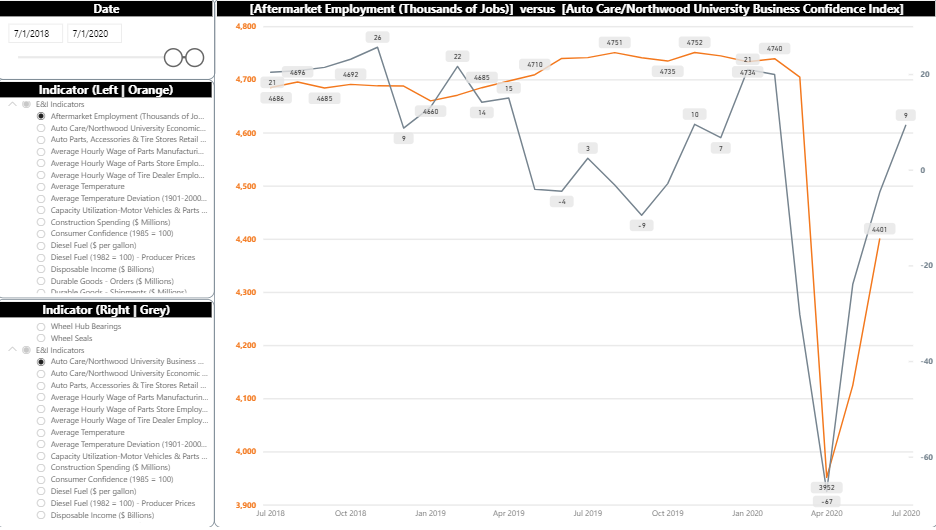

Employment and the aftermarket’s business confidence index (BCI, based on a monthly survey of the aftermarket asking to “rate overall confidence in the economic prospects facing your business over the next 12 months, compared to the previous 12 months”) have dropped and risen together throughout the pandemic. In the chart below, aftermarket employment is in orange, and BCI is in gray.

Source:

TrendLens. Date range: July 1, 2018 - July 1, 2020.

Source:

TrendLens. Date range: July 1, 2018 - July 1, 2020.

Recent governmental data confirms the sizable contribution that the automotive industry has had for the nation’s manufacturing economy:

- Manufacturing, the biggest component of production, rose 3.4%, driven by a 28.3% increase in car and car parts industries.

- Capacity utilization rose to 70.6% in July from a revised 68.5% in June – economists had expected capacity utilization to reach 70.2%.

(Source: “U.S. Industrial Production Rises for Third Straight Month”, The Wall Street Journal, Aug. 14, 2020. https://www.wsj.com/articles/u-s-industrial-production-rises-for-third-straight-month-11597420400)

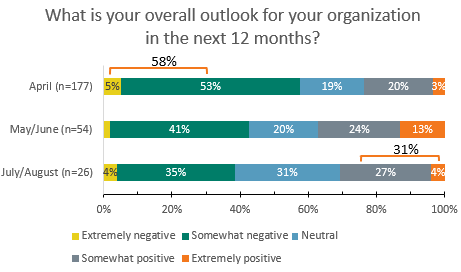

In our ongoing survey with members about the impacts of COVID-19, outlook for the next 12 months has shifted from somewhat negative in April (58% “somewhat” or “extremely negative”) to being more positive in May/June and July/August (based on 257 responses collected through mid-August). Nearly one-third of auto care organizations participating in July/August have a “somewhat” or “extremely positive” outlook (31%), versus one-quarter of organizations participating in April (23%).

Concern regarding cash position has reduced and stabilized over the summer: one-third of companies were highly concerned in April (36%) before dropping to one-in-seven in May/June (15%) and one-in-eight in July/August (12%) – this is likely attributable to securing of government relief in May/June, adjusting to the current business environment conditions, and as drivers returned to the road and serviced their vehicles in the summer. While statistics are not available on this topic prior to the pandemic, we expect there to be a baseline percentage of companies that face financial challenges even in the absence of a national crisis.

To address this concern, aftermarket companies tended to furlough and lay off employees, decrease salaries for both executives and employees, and reduce employee hours while also cutting back on other unnecessary expenses. Furloughs and layoffs tended to be more frequent in the first several months of the pandemic. As the pandemic continued into June and July, aftermarket companies continued to reduce expenses, cut salaries, and defer investments. This suggests that the pandemic continues to cause companies financial pain.

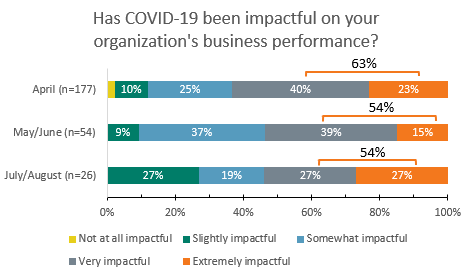

Similarly, impact on business performance continues to be high for more than half the aftermarket, holding steady at 54%, a nominal decrease from 63% in April:

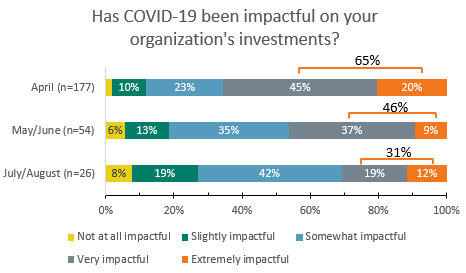

Also noteworthy is the lower impact on investments over the months – falling from 65% in April to 31% in July/August.

Shops who have invested in modernizing their facilities, systems, and services to enhance the customer experience (e.g., online scheduling, touchless contact) prior to the pandemic have been realizing the fruit of their previous investments and continue to focus on caring for and communicating with their customers.

As the summer winds down and fall begins, we will see if new patterns emerge among business owners across the industry and keep you informed of updates and how they may impact the industry. In the meantime, keep those rally caps and rally towels out – the aftermarket is continuing to fight, and I’m confident that we’re going to finish it strong!

Get even more insights from TrendLens, our interactive data platform, free for members here.

Read more Market Insights with Mike here .

Mike Chung is director, market intelligence at Auto Care Association. With

more than a dozen years of experience in market research, Chung and his team

provide the industry with timely information on key factors and trends

influencing the health of the automotive aftermarket and serving as a critical

resource by helping businesses throughout the supply chain to make better

business decisions. Chung has earned several degrees, including a Bachelor of

Science in chemical engineering from Massachusetts Institute of Technology

(MIT), a Master of Science in environmental health management from Harvard

University and a Master of Business Administration with a concentration in

marketing from Montclair State University. Mike can be reached at

michael.chung@autocare.org.

Mike Chung is director, market intelligence at Auto Care Association. With

more than a dozen years of experience in market research, Chung and his team

provide the industry with timely information on key factors and trends

influencing the health of the automotive aftermarket and serving as a critical

resource by helping businesses throughout the supply chain to make better

business decisions. Chung has earned several degrees, including a Bachelor of

Science in chemical engineering from Massachusetts Institute of Technology

(MIT), a Master of Science in environmental health management from Harvard

University and a Master of Business Administration with a concentration in

marketing from Montclair State University. Mike can be reached at

michael.chung@autocare.org.

Michael Chung, Director, Market Intelligence

Ready to dive into market research? I provide the industry with timely information on key factors and trends influencing the health of the automotive aftermarket and serving as a critical resource by helping businesses throughout the supply chain to make better business decisions. More About Me

Market Insights with Mike is a series presented by the Auto Care Association's Director of Market Intelligence, Mike Chung, that is dedicated to analyzing market-influencing trends as they happen and their potential effects on your business and the auto care industry.

More posts

Content

-

[WATCH] Driver Behavior Trends and Their Impact on Parts and Service Opportunities

March 17, 2022This webinar analyzes driving behavior at the national, state, and local levels. Gain insights into: consumer behavior; driving patterns; and potential impacts on parts replacement, service and repair scheduling, vehicle age, and the car parc.

-

[WATCH] 2022 Business Outlook: Top Emerging Opportunities and Challenges

February 4, 2022This webinar explores need-to-know emerging opportunities and challenges for the coming year: current status of supply chain issues and what to expect in the year ahead and more.

-

[WATCH] How to Use Vehicle Miles Traveled to Better Your Bottom Line in 2022

December 3, 2021Vehicle Miles Traveled has been respected for years as a key indicator of aftermarket opportunities. Historically, planning has been limited to directional indicators but now aftermarket businesses can leverage more detailed insights on geographic differences as well as vehicle differences to more effectively take advantage of aftermarket opportunities.