Positioning for Advocacy in a Changing Environment

As another election season comes and goes, there will be much discussion among

pundits and politicos in the coming weeks about their predictions for the next

two years (until the next election cycle). This edition of

Market Insights with Mike focuses on cutting through the noise and

instead examines the data most important to aftermarket professionals for

continued success in an ever-evolving economy.

While it’s a little early for a year-in-review, several trends have emerged across our society and industry as we navigate the market each month, week, and day:

- Remote Learning: As of Oct. 19, two-thirds of U.S. K-12 students were attending school virtually: 43% full-time, 23% in a hybrid format (combination of in-classroom and remote learning) ( Burbio) – down from 62% full-time and 18% hybrid in early September ( Burbio).

- Remote Work: Prior to the pandemic, the Bureau of Labor Statistics estimates that “a little more than 10 percent of workers … spent any paid workday working only at home” ( U.S. Bureau of Labor Statistics). Some experts now estimate that “25-30% of the workforce will [work] at home on a multiple-days-a-week basis by the end of 2021” ( Global Workplace Analytics).

- Road Trips: AAA estimates that 80% of travel this fall will be via automobile ( AAA).

Consumer Behavior

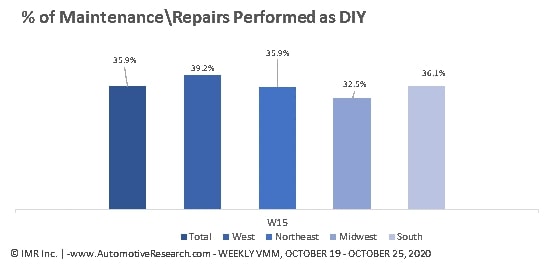

According to IMR Inc. ( AutomotiveResearch.com), Do-It-Yourself (DIY) activity climbed from 30.8% in 2020 Q1 to a peak of 43.3% in early August. Since then, DIY has receded to 35.9% and varies regionally as illustrated below. As the weather gets colder, experts expect DIY to decline, particularly in northern climates.

Financial Performance

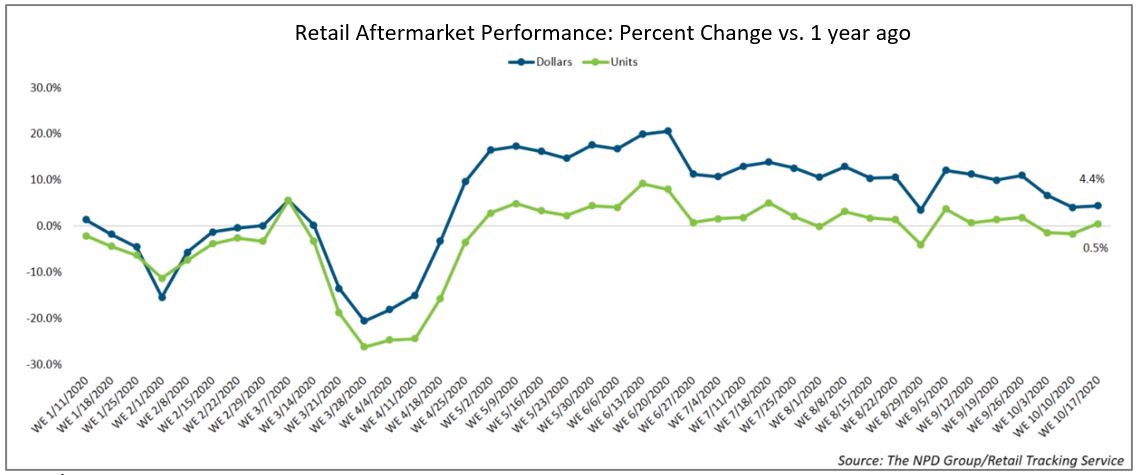

The NPD Group reports that the retail, front room aftermarket has grown 6.9% year-to-date based on dollar volume of sales. As displayed in the chart below (Jan.-Oct. 2020), unit sales were up 0.5% year-over-year for the week ending Oct. 17, 2020.

When looking at the past two years of retail sales data for U.S. auto parts, accessories, and tire stores, we see how the post-pandemic recovery led to higher-than-normal sales throughout the summer.

Source: TrendLens™, Auto Care Association

Source: TrendLens™, Auto Care Association

Industry Activity

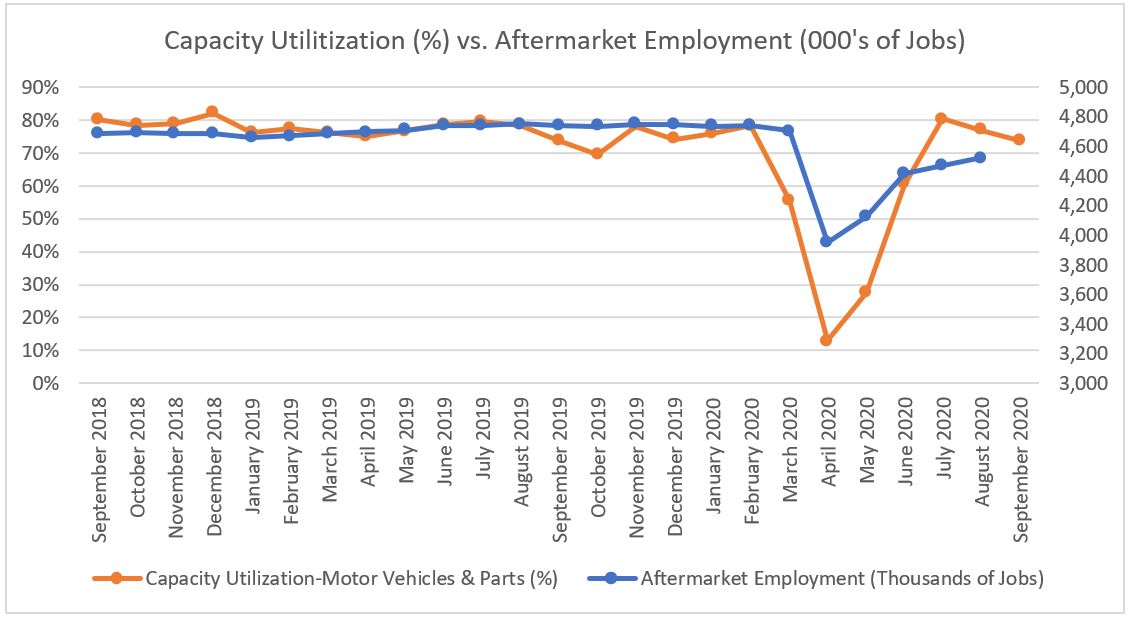

During the pandemic, U.S. production activity for motor vehicles and parts fell to 12% in April (orange line in chart below), concurrent with a 16% drop in aftermarket employment (blue line) from March to April. Since then, both indicators have rebounded quickly. While aftermarket employment is not as high as its pre-pandemic levels, it rose steadily in the summer.

Source: TrendLens™, Auto Care Association

Source: TrendLens™, Auto Care Association

Legislation

During the summer, the Auto Care Association’s Government Affairs team worked with business groups and other stakeholders to develop appropriate responses to COVID-19. Since the federal government deferred COVID-19 action to the states, local officials played a leading role in shaping the national response with worker protection legislation and business liability as the defining issues.

Worker protection measures include workers’ compensation, unemployment insurance and hazard pay for essential workers. States are taking action to amend laws so that COVID-19 infections are presumed to be work-related and covered under workers’ compensation. This presumption places the burden on the employer to prove that the infection was not work-related, making it easier for those workers to file claims. States have also been implementing a variety of emergency rules and actions for unemployed workers affected by COVID-19 including extending benefits to employees who are under quarantine, increased payments and waiving certain requirements. Hazard pay refers to additional compensation for front line or essential workers.

Business liability protection is an important operational aspect for the aftermarket given its status as an essential industry amidst the pandemic. Significant considerations apply to both employers and employees. For example, if an employer follows government-issued safety guidelines and protocols but an employee still contracts the virus, is the employer liable? What if an employee's family then becomes infected, or if an employee or their dependent dies from COVID-19? Should companies that take appropriate steps and follow safety guidelines be liable? That is a major topic of debate in state legislatures, the business community, and the aftermarket. There have been 39 state bills related to business liability introduced in 27 states: 13 have passed and 26 have failed. You should expect more debate surrounding business liability protections as more workers return to the workplace.

Sentiment

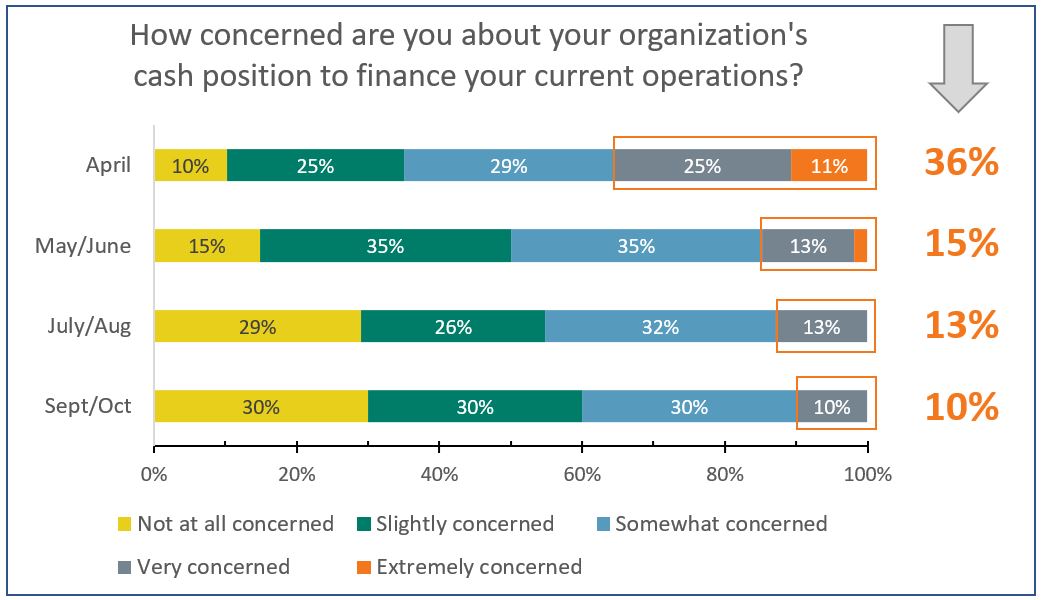

Concern of cash position was high in the beginning of the pandemic. Concern stabilized as stimulus funding was distributed and as companies adapted to evolving business conditions.

Source: Auto Care Association. Based on 272 responses collected from Apr.

6-Oct. 26, 2020.

Source: Auto Care Association. Based on 272 responses collected from Apr.

6-Oct. 26, 2020.

Industry Outlook

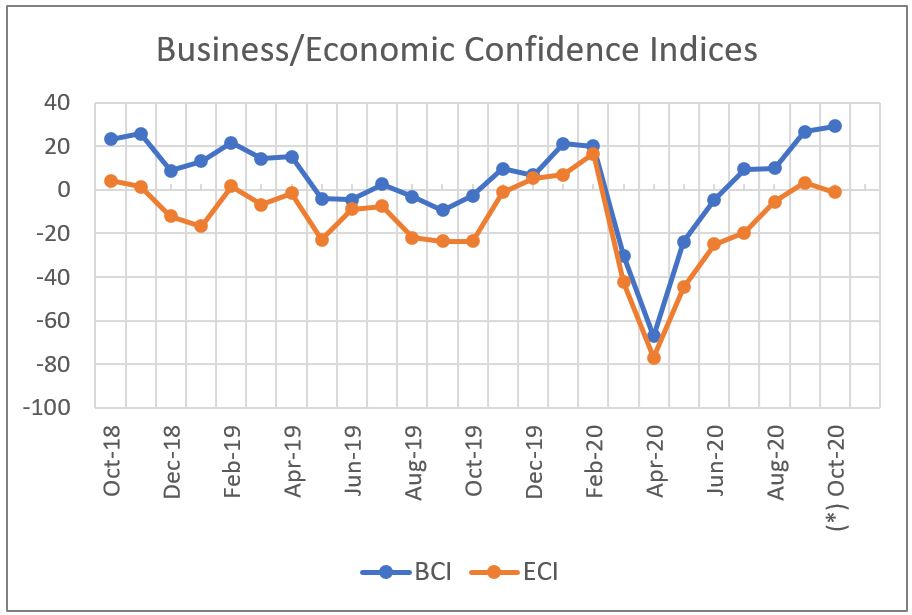

In our monthly survey to all members, the Auto Care Association asks aftermarket professionals to rate their overall confidence in the economic prospects facing their businesses (Business Confidence Index) and the economy as a whole (Economic Confidence Index) over the next 12 months, compared to the previous 12 months. While both indices dropped to their lowest levels in April, they have rebounded since then.

Source: Auto Care Association. (*) Preliminary.

Source: Auto Care Association. (*) Preliminary.

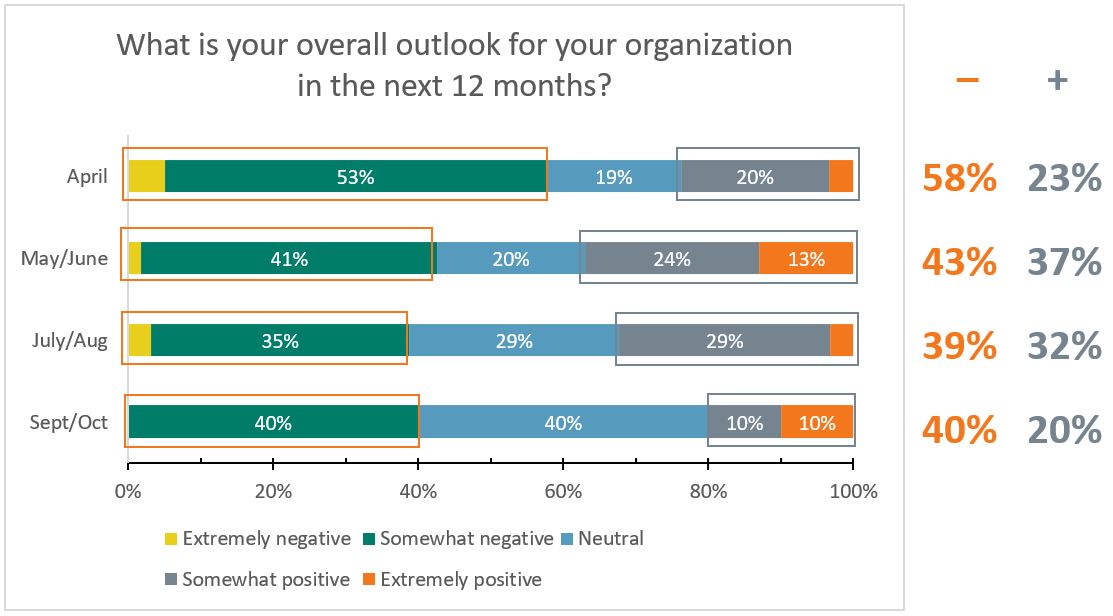

Similarly, in our association’s COVID-19 impact survey, while negative sentiment has reduced throughout the pandemic, positive outlook increased throughout the summer before receding in the fall. The latter may be attributable to longer forecasts for remote work and remote schooling, as well as uncertainties associated with the election.

Source: Auto Care Association. Based on 272 responses collected from Apr.

6-Oct. 26, 2020.

Source: Auto Care Association. Based on 272 responses collected from Apr.

6-Oct. 26, 2020.

Advocacy and Business Operation Considerations

The Auto Care Association’s Government Affairs team has been advising members on the importance of establishing a relationship with their federal, state, and local representatives. If the elected officials know who their organizations employ, how many employees in their district, how wide their service territory, and the economic impact of their business in the state or district, they will be better able to represent your business interests, as well as our industry, on Capitol Hill, in state capitals and in municipal government.

At the beginning of the pandemic, the Auto Care Association was able to impress upon our legislators the importance of our industry. This is due to our longstanding relationships with legislators and officials at the federal and state level. As the victors are declared and the election season comes to a close, the weeks following the election are an opportune time for you to reach out to your newly elected or re-elected representatives to congratulate them on their success. Invite them to your facility for a tour – they should be more than eager to connect with you and build a relationship so that you can make your voice more powerfully heard at all levels of government.

After all, priority tends to be given to established relationships, not new ones. As Tom Tucker, senior director, state affairs, Auto Care Association, likes to say, “You have a powerful voice and a unique story to tell. Who have you told your story to in the political world?”

Communication – Representatives and Suppliers, Customers

As we approach year-end, we double down on emphasizing best practices shared by members across the supply chain. We continue to hear the importance of setting and managing expectations with both your suppliers and your customers.

Inventory management has been a challenge across the industry. Based on our

COVID-19 impact survey (*), nearly half of aftermarket companies (46%) report

a moderate or higher level of supply chain disruptions. Shop owners emphasize

the importance of talking with suppliers and distributors to gauge how many

products are available and when, in concert with providing customers updates

on vehicle status and projected completion time.

(*): Available

here

– we encourage you to take it from time to time for tracking purposes

Similarly, pro-actively communicating with your customers on any changes in service, especially amidst the pandemic, helps customers and prospects know that they are up-to-date with your practices. Informing of changes to health and safety practices, business hours, drop-off/pick-up protocols, and the like has proven to be effective in assuring customers that you have adapted to keep their best interests in mind.

Closing and Additional Resources

These issues will continue to persist well after the election. Remote advocacy, virtual legislation, employee rights legislation, and other topics will continue to be salient – stay up-to-date with market trends at the Auto Care Association’s Market Intelligence webpage and with advocacy updates at our Government Affairs webpage.

In closing, we invite you to take advantage of our resources at the Auto Care Association for engaging with your elected officials. Please visit our Advocacy 101 page for guidance on engaging with your federal and state representatives. Some of the market data featured above is from our TrendLens™ data platform. Auto Care Association mMembers have free access to these data sets at our TrendLens™ site.

Read more Market Insights with Mike here .

Mike Chung is director, market intelligence at Auto Care Association. With

more than a dozen years of experience in market research, Chung and his team

provide the industry with timely information on key factors and trends

influencing the health of the automotive aftermarket and serving as a critical

resource by helping businesses throughout the supply chain to make better

business decisions. Chung has earned several degrees, including a Bachelor of

Science in chemical engineering from Massachusetts Institute of Technology

(MIT), a Master of Science in environmental health management from Harvard

University and a Master of Business Administration with a concentration in

marketing from Montclair State University. Mike can be reached at

michael.chung@autocare.org.

Mike Chung is director, market intelligence at Auto Care Association. With

more than a dozen years of experience in market research, Chung and his team

provide the industry with timely information on key factors and trends

influencing the health of the automotive aftermarket and serving as a critical

resource by helping businesses throughout the supply chain to make better

business decisions. Chung has earned several degrees, including a Bachelor of

Science in chemical engineering from Massachusetts Institute of Technology

(MIT), a Master of Science in environmental health management from Harvard

University and a Master of Business Administration with a concentration in

marketing from Montclair State University. Mike can be reached at

michael.chung@autocare.org.

Michael Chung, Director, Market Intelligence

Ready to dive into market research? I provide the industry with timely information on key factors and trends influencing the health of the automotive aftermarket and serving as a critical resource by helping businesses throughout the supply chain to make better business decisions. More About Me

Market Insights with Mike is a series presented by the Auto Care Association's Director of Market Intelligence, Mike Chung, that is dedicated to analyzing market-influencing trends as they happen and their potential effects on your business and the auto care industry.

More posts

Content

-

[WATCH] Driver Behavior Trends and Their Impact on Parts and Service Opportunities

March 17, 2022This webinar analyzes driving behavior at the national, state, and local levels. Gain insights into: consumer behavior; driving patterns; and potential impacts on parts replacement, service and repair scheduling, vehicle age, and the car parc.

-

[WATCH] 2022 Business Outlook: Top Emerging Opportunities and Challenges

February 4, 2022This webinar explores need-to-know emerging opportunities and challenges for the coming year: current status of supply chain issues and what to expect in the year ahead and more.

-

[WATCH] How to Use Vehicle Miles Traveled to Better Your Bottom Line in 2022

December 3, 2021Vehicle Miles Traveled has been respected for years as a key indicator of aftermarket opportunities. Historically, planning has been limited to directional indicators but now aftermarket businesses can leverage more detailed insights on geographic differences as well as vehicle differences to more effectively take advantage of aftermarket opportunities.