Aftermarket Trends in China Amidst COVID-19

In this issue, we turn our attention to China. As the world’s second largest

economy, and one that has demonstrated rapid economic growth in recent

decades, we conferred with Haisheng Chen, Chief Editor of AC Auto, a division

of AC Qiche, a Shanghai-based business consulting specialist focused on the

automotive retail and service sector, as well as Steve Ganster of YCP

Solidiance, an Asia-focused strategy consulting firm, to learn more about

consumer trends related to driving, maintenance, and vehicle purchase. While

many trends parallel those observed in the United States, nuanced differences

exist.

Prelude – Pre-Pandemic Economic Backdrop

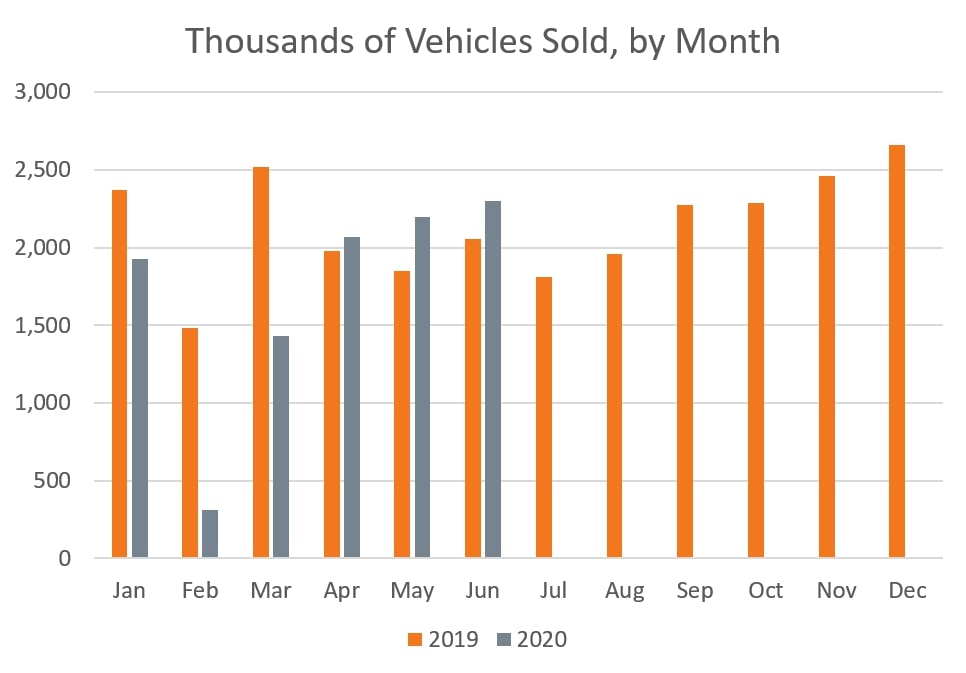

Prior to the pandemic, China’s automotive industry had already slowed down – vehicle sales in 2018 decreased for the first time since 2001, to 28.08 million units (-2.7%), then dropped 8.2% in 2019:

Source: “The Future of Mobility in China: Internet of Vehicles”, YCP

Solidiance, February 2020, sourced from China Association of Automobile

Manufacturers.

Source: “The Future of Mobility in China: Internet of Vehicles”, YCP

Solidiance, February 2020, sourced from China Association of Automobile

Manufacturers.

Pandemic Travel Trends

In the first month of the pandemic, personal automotive travel in China was minimal – residents used their automobiles for essentials – commuting, medical care, and purchase of daily necessities. As time passed, Chinese used their cars for trips within 300km (187.5 miles, about 3 hours).

From January-May 2020, passenger trips by bus and rail decreased by 54.0% and 48.2% year-over-year, respectively. By July, airline and rail providers in China began seeing recovery: domestic flights climbed back to 90% of pre-pandemic levels, while high-speed rail reached about 60%. As in the United States, though, many are still canceling unnecessary trips.

Ganster notes that Chinese sentiment toward commuting via private car has increased significantly and has become one of the key drivers of personal vehicle sales, helping drive sales recovery. Although public transit traffic is gradually recovering, this likely reflects the return to work for most individuals who would ordinarily take mass transit, as most individuals who take public transit cannot afford their own car.

AC Qiche expects “no significant difference in the number of self-driving miles compared with the same period last year.” After the ban, the number of vehicle miles traveled has increased. While automobiles are the preferred means of transport for short trips, high-speed rail and airplane are preferred for medium and longer trips.

Repair Shop Trends

Repair shops have responded to the pandemic in ways similar to what we have observed in the United States: shops are cleaning and sanitizing vehicles for customers; businesses are sharing knowledge with customers to promote vehicle maintenance; auto care businesses are supporting frontline medical workers with complimentary service, as well as providing personal protective equipment (PPE, such as masks) to medical facilities.

Learn how to support shop owners as they navigate the current environment, plus tips for cultivating successful partnerships with service and repair facilities in this webinar here .

Source: AC Auto survey of auto repair shops

Source: AC Auto survey of auto repair shops

In America, we have seen significant migration to the Internet in business and education contexts, and repair shops are similarly exploiting online resources to strengthen supply chain activities, conduct online sales, communicate with customers, and book appointments. Chen observes that while short-term objectives have largely been addressed, medium/long-term challenges of how to change the business model and achieve “online operation” are considerable, which has also led to the rapid rise of franchises like Tuhu and Tmall, as well as other Internet platforms in the automotive aftermarket in China.

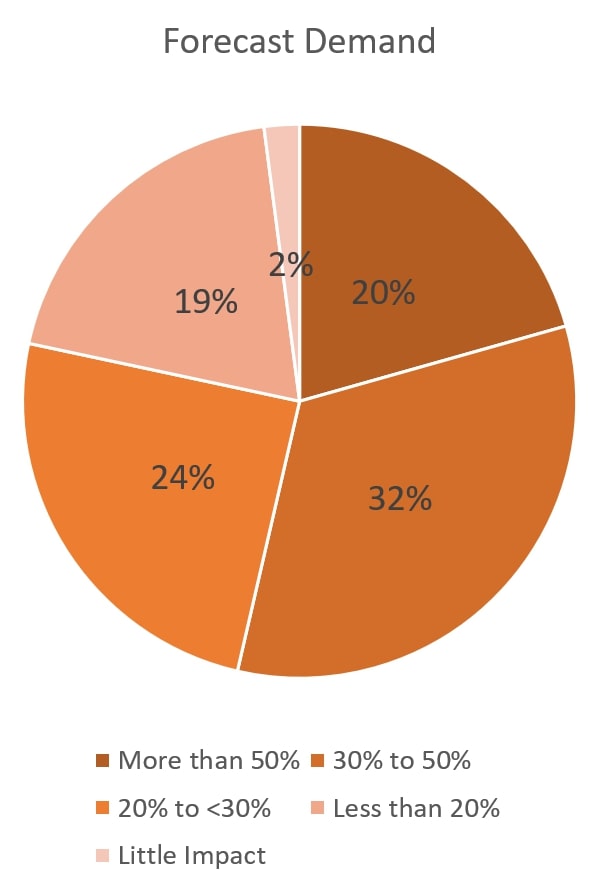

Chen notes, “With the decrease in driving during the pandemic, China has experienced a decline in maintenance and repair. While maintenance and sterilization are top services performed at repair shops (based on an AC Auto survey of auto repair shops), many garages have closed based on forecast demand during 1H2020.” (see chart above)

Ganster confirms the trend of accelerated consolidation and digitalization in China’s auto aftermarket in the post-pandemic era: “As many small repair shops are struggling to survive in a market with reduced demand (less travel, fewer accidents) and adapt to the increasing customer requests for the online service model, many are forced to close their business. Meanwhile, giant auto aftermarket players like Tuhu will further leverage their online service and digital capability to consolidate offline repair shops and provide standardized and seamless online-to-offline auto after-service.”

The key challenge for repair shops remains the need to further adapt their service and business model (e.g. remain profitable with fewer parts sales, increasing online/digital investment amidst high rental costs) to meet the changing customer behavior that prefers fast, contactless maintenance service, as well as more online activities, including service booking, parts selection, and purchase.

Ganster also identifies regulatory requirements as an emerging challenge: “These may play a role in the short-term and in certain areas where new cases are emerging, and repair shops might be required to close their business temporarily, but the overall impact still remains low.”

Consumer Behavior and Repair Shop Expectations

As in the United States, vehicle owners cancelled unnecessary trips and delayed maintenance. During the outbreak, delaying maintenance was also very common in China.

The general shift to eCommerce in China has paved a path for vehicle owners to conduct automotive transactions online. Chen shares that “Chinese consumers have been accustomed to online payments (e.g., WeChat, Alipay) due to the high popularity of e-commerce and mobile payment. While vehicle delivery/take-up services are not common, home delivery services have a relatively stable and small market share.”

As such, Ganster anticipates a shift in customer expectations: “As customers become familiar with online service platforms that exhibit a better proactive notification system, they expect a better maintenance compliance schedule in the long run, particularly as they increasingly expect a seamless online and offline experience which can provide easy-to-use online reservation and service functions with quick and contactless offline service.”

Based on surveys conducted by AC Auto, this sentiment reverberates up the supply chain as shops see higher consumer expectations in response to the current health crisis:

- 36% of shops indicate that car owners attach more importance to standards and safety and have higher requirements for stores.

- 22% of shops project that customers will prefer online communication and booking habits.

Vehicle Sales

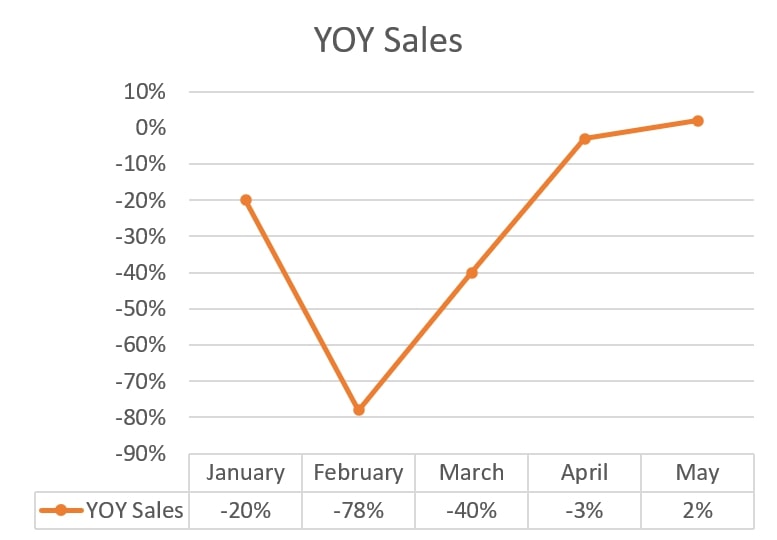

As noted, vehicle sales have trended downward the past two years. Not surprisingly, YOY vehicle sales were significantly lower in the first several months of the pandemic, then rose considerably in May: 1.6 million units were sold, a 2% YOY increase from May 2019.

Health concerns due to COVID-19 have encouraged many Chinese to invest in their own vehicle – research by Ipsos and CAA indicates that “reducing the chance of getting infections” is the number one reason for people to buy a new car (57%). Furthermore, consumers who did not have a vehicle purchase plan prior to the pandemic value this risk factor more in their car purchase consideration (62%).

According to Chen, new car sales in May were aided by holiday discounts and policy dividends – where local governments offer cash subsidies (from 1,000-20,000 yuan, or $144-$2,877) for the purchase of new energy vehicles or vehicles with National Emission Standard 6. As is happening in the United States, used car prices fell in May, likely in response to the decrease in new car sales and to compete with the higher number of new vehicles on the market.

Ganster notes that China vehicle sales’ V-shaped recovery seems consistent with this consumer sentiment: despite the steep decline in February and March, vehicle sales volume quickly recovered in April, May and June. Vehicle sales volume in June reached 2.3M units vs. 2.06M a year ago. The chart below illustrates personal vehicle sales by month 2019/2020.

Source: China Association of Automobile Manufacturers (http://www.caam.org.cn/tjsj)

Source: China Association of Automobile Manufacturers (http://www.caam.org.cn/tjsj)

Ganster notes that as vehicle sales increased in May and June, “Vehicle OEMs did not provide special incentives for distributors as they are also struggling with the steep decline of sales globally. Most common measures adapted by OEMs are to temporarily remove the KPI target (e.g., sales volume, revenue, traffic) for distributors. Most of the distributors provide adequate discounts to customers for stock clearance and to improve their cash flow. This sales incentive seems to work well particularly for premium brands (e.g., Mercedes-Benz, Audi, BMW) and attracts high-income customers who are less impacted by the pandemic. They are mostly first-generation car owners and willing to spend money on their second car. In June, new vehicle sales in the premium segment increased 27% YoY, 9% MoM, and hit a historic high 14.9% market share.”

Outlook

Like the United States, the Chinese automotive industry is watching COVID-19 caseloads, business reopening patterns, and consumer behavior across its geographic regions. Use of internet technology has led to the emergence of new entrants to the supply chain, a disruption of sorts. Time will tell if these new businesses will hold their niche of the market, as well as if consumer behavior and expectations from service providers “sticks”.

Get even more insights from TrendLens, our interactive data platform, free for members here.

Read more Market Insights with Mike here .

Mike Chung is director, market intelligence at Auto Care Association. With

more than a dozen years of experience in market research, Chung and his team

provide the industry with timely information on key factors and trends

influencing the health of the automotive aftermarket and serving as a critical

resource by helping businesses throughout the supply chain to make better

business decisions. Chung has earned several degrees, including a Bachelor of

Science in chemical engineering from Massachusetts Institute of Technology

(MIT), a Master of Science in environmental health management from Harvard

University and a Master of Business Administration with a concentration in

marketing from Montclair State University. Mike can be reached at

michael.chung@autocare.org.

Mike Chung is director, market intelligence at Auto Care Association. With

more than a dozen years of experience in market research, Chung and his team

provide the industry with timely information on key factors and trends

influencing the health of the automotive aftermarket and serving as a critical

resource by helping businesses throughout the supply chain to make better

business decisions. Chung has earned several degrees, including a Bachelor of

Science in chemical engineering from Massachusetts Institute of Technology

(MIT), a Master of Science in environmental health management from Harvard

University and a Master of Business Administration with a concentration in

marketing from Montclair State University. Mike can be reached at

michael.chung@autocare.org.

Michael Chung, Director, Market Intelligence

Ready to dive into market research? I provide the industry with timely information on key factors and trends influencing the health of the automotive aftermarket and serving as a critical resource by helping businesses throughout the supply chain to make better business decisions. More About Me

Market Insights with Mike is a series presented by the Auto Care Association's Director of Market Intelligence, Mike Chung, that is dedicated to analyzing market-influencing trends as they happen and their potential effects on your business and the auto care industry.

More posts

Content

-

[WATCH] Driver Behavior Trends and Their Impact on Parts and Service Opportunities

March 17, 2022This webinar analyzes driving behavior at the national, state, and local levels. Gain insights into: consumer behavior; driving patterns; and potential impacts on parts replacement, service and repair scheduling, vehicle age, and the car parc.

-

[WATCH] 2022 Business Outlook: Top Emerging Opportunities and Challenges

February 4, 2022This webinar explores need-to-know emerging opportunities and challenges for the coming year: current status of supply chain issues and what to expect in the year ahead and more.

-

[WATCH] How to Use Vehicle Miles Traveled to Better Your Bottom Line in 2022

December 3, 2021Vehicle Miles Traveled has been respected for years as a key indicator of aftermarket opportunities. Historically, planning has been limited to directional indicators but now aftermarket businesses can leverage more detailed insights on geographic differences as well as vehicle differences to more effectively take advantage of aftermarket opportunities.