October 6, 2025

Freight/Shipping Trends and Impact on Aftermarket

by Michael Chung

O data, where art thou?

We are in the first federal government shutdown since the 35-day shutdown from Dec. 22, 2018 to Jan. 25, 2019. As noted by Seeking Alpha, “There will be no weekly jobless claims figures Thursday or September jobs report Friday,” “the CPI is in question” and “Deputy Commissioner William J. Wiatrowski is now the only one working at” the Bureau of Labor Statistics.I wrote recently about labor trends in the automotive aftermarket in light of tariffs, so let’s take a look at some trends in the freight market and what we might expect.

Port Capacity Steady

U.S. port capacity is looking good – as of Sept. 21 containership capacity at U.S. ports has been steady throughout the year and is comparable with recent years (Figure 1 below)

Figure 1 – Containership Capacity at U.S. Ports

U.S. Department of Transportation, Bureau of Transportation Statistics

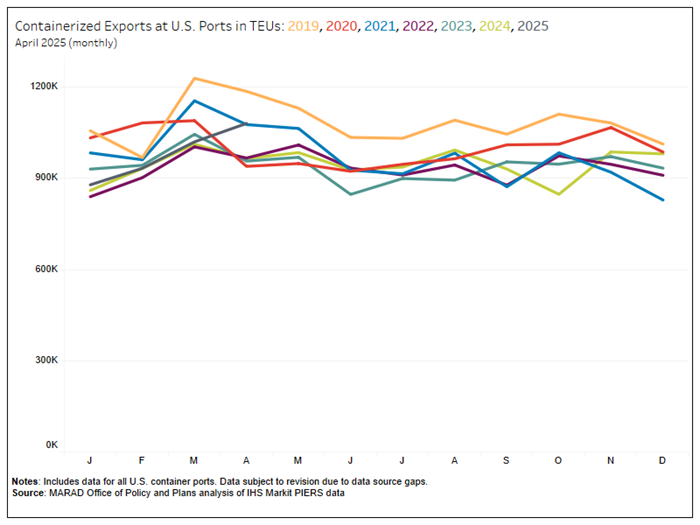

The higher capacity is likely due to lower import levels since March 2025 (spike at far right of Figure 2). Figure 3 charts containerized imports at U.S. ports through May 2025 (black line) – I expect this line to drop for June, July and August.

Figure 2: U.S. Imported Goods

U.S. Department of Transportation, Bureau of Transportation Statistics

Figure 3: U.S. Containerized Imports through May 2025

U.S. Department of Transportation, Bureau of Transportation Statistics

Figure 4: PPI for Trucking Services

U.S. Department of Transportation, Bureau of Transportation Statistics

BTW, PPI data are collected monthly, so we may have a lag in data collection and reporting.

However, the final cost of goods to end consumers is likely to get higher, because of …

Demand Surcharges

FedEx and UPS implemented a demand surcharge during peak shipping seasons (say, Black Friday to Christmas) and have expanded the time range over the years. For 2025, these surcharges will be in effect for 111 days – nearly four months. This surcharge applies to almost all shipments and ranges from $0.40 to $545 per package.The surcharge amount is based on the type of delivery (ground, air, residential, domestic, international) and size (e.g., requires additional handling based on weight, dimensions or irregular packaging).

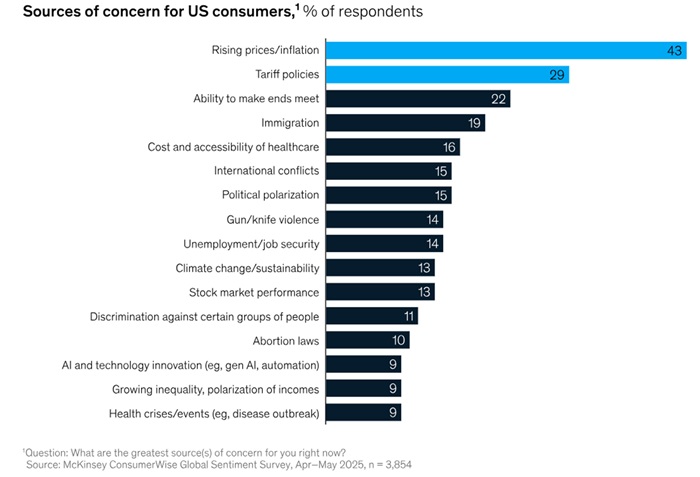

Given consumer concerns over inflation and tariffs (Figure 5 below) and tightened job market (more on that below), shippers can reduce fees by splitting packages to avoid additional handling surcharges, redesigning packaging to meet size and weight limits, and scheduling shipments outside the surcharge period when possible.

Figure 5 – Sources of Concern for U.S. Consumers

McKinsey & Company

The straw that breaks the consumer’s back?

As we approach year-end, sustained inflation and a difficult job market suggest that consumer spend will continue to be challenged. As noted in Figure 6, inflation (personal consumption expenditures) was 2.7% in August 2025 and is forecast at 3.0% as we close out the year.Figure 6 – Steady inflation through 2025

Ernst & Young Quantitative Economics and Statistics (QUEST) group, Sept. 29, 2025

Job markets continue to be challenging, with the underemployment rate having risen steadily over the past 24 months:

Figure 7: Underemployment Trends

Bloomberg

And while we wait for the next Federal jobs report, data from payroll services provider ADP suggest that the labor market will continue to be challenging, with net job losses in August and September:

Figure 8: Hiring Trends

Seeking Alpha

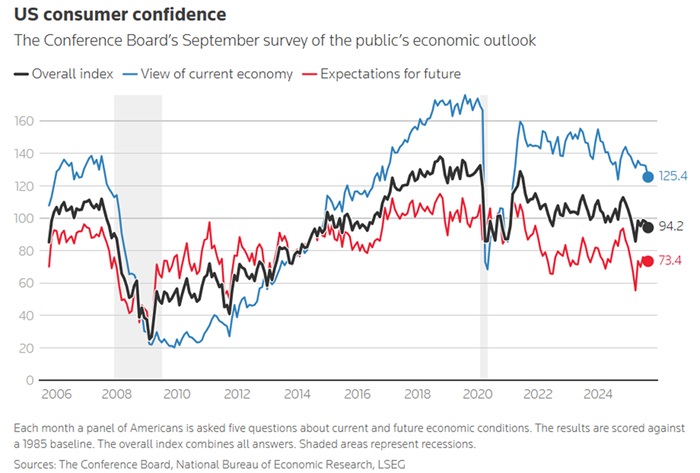

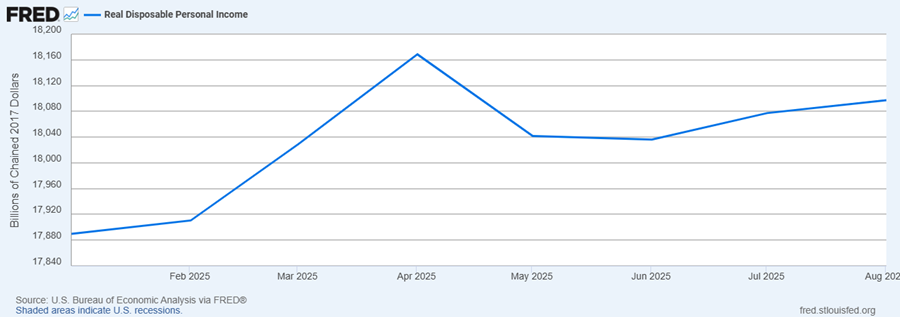

Meanwhile, consumer confidence has tapered (Figure 9) while disposable income has nudged upward (Figure 10):

Figure 9: Consumer Confidence Tapering

Reuters

Figure 10: Disposable Income Growth in 2025

U.S. Bureau of Economic Analysis, Real Disposable Personal Income [DSPIC96], retrieved from FRED, Federal Reserve Bank of St. Louis; October 3, 2025.

So where does this all lead?

Increased shipping prices will be another burden on already beleaguered consumers. Aftermarket providers could do their customers a solid by absorbing the additional surcharges but it’s already a tough environment amidst navigating dynamic tariff policies.

As reported by Bloomberg, parts manufacturer AlphaUSA pays “about $250,000 a month in additional costs from tariffs on imported fasteners.” President and chief operating officer Charles Dardas describes the extra costs as “a threat to our existence” and as a hurdle for hiring.

Staff reductions are risky for the 200-employee company because of the challenge of finding the right employees for specialized roles: “It’s quite a conundrum for us and for many others”.

Long story short: higher prices due to surcharges will likely lead to higher prices for consumers, who would likely purchase less, possibly change brands / move to a value product, or delay purchase.

As reported by Bloomberg, parts manufacturer AlphaUSA pays “about $250,000 a month in additional costs from tariffs on imported fasteners.” President and chief operating officer Charles Dardas describes the extra costs as “a threat to our existence” and as a hurdle for hiring.

Staff reductions are risky for the 200-employee company because of the challenge of finding the right employees for specialized roles: “It’s quite a conundrum for us and for many others”.

Long story short: higher prices due to surcharges will likely lead to higher prices for consumers, who would likely purchase less, possibly change brands / move to a value product, or delay purchase.

Welcome to the new YANG Effect! Your one-stop quarterly newsletter for all things Automotive Aftermarket contributed to and written by under-40 industry professionals.

More posts

Market Insights with Mike is a series presented by the Auto Care Association's Director of Market Intelligence, Mike Chung, that is dedicated to analyzing market-influencing trends as they happen and their potential effects on your business and the auto care industry.

More posts

Subscribe to updates