Aftermarket Employment Trends

Competitive Job Environment

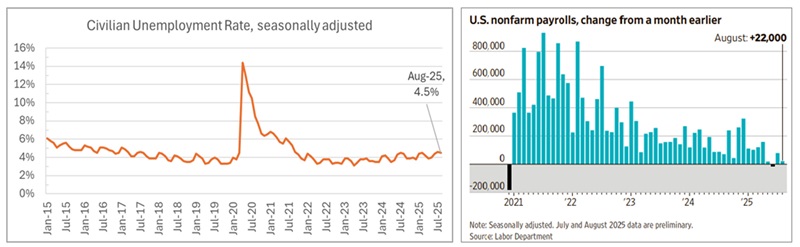

The U.S. job market has become increasingly more more competitive in recent months: unemployment has hovered around 4% for the past several years while job creation has generally curtailed over the same time period, with a modest number of new jobs added in August (22,000):

Sources: Unemployment: TrendLensTM/U.S. Bureau of Labor Statistics; U.S. Nonfarm Payrolls: The Wall Street Journal, “Hiring Stalled in August, with 22,000 New Jobs”, Sept. 5, 2025

Over the past three years, the general labor market has become more competitive, with an increasing number of unemployed persons per job opening:

Source: U.S. Bureau of Labor Statistics (click here)

Job Creation Trends

It’s fair to say that the job creation in the automotive aftermarket has been a laggard based on job opening rates by industry:

Source: U.S. Bureau of Labor Statistics

The pink line represents “total nonfarm” while the three callouts are proxies for the automotive aftermarket – durable goods manufacturing (purple), wholesale trade (dark green) and retail trade (light green) – and slope more sharply downward than total nonfarm, suggesting that the aftermarket is lagging, with a lower job creation rate.

With lower job creation rates than other industries, it is quite possible that job creation will be further stalled if tariffs are in fact implemented. Agricultural manufacturer John Deere announced layoffs recently due to declining sales and tariff impacts (click here to read more).

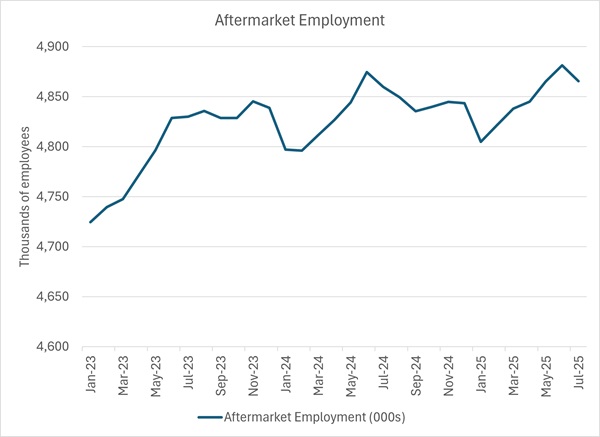

Aftermarket employment has generally held steady in recent years:

Source: TrendLensTM (click here)

Of course, fluctuation may vary for companies based on the discretionary aspect of their corresponding products as well as the company type. Regarding the latter, it is worth noting that employment for parts manufacturers is more susceptible to tariff impacts than wholesalers, retailers and repair shops. This is evident in the chart below - employment at motor vehicle parts manufacturing establishments (light blue line) has decreased over the past 12 months):

Source: U.S. Bureau of Labor Statistics (click here)

After all, if parts manufacturers are more susceptible to needing to relocate due to the fluid nature of tariffs/trade policy. Parts wholesalers seem less likely to move locations as they need to be near their customers. While parts retailers likely face some seasonal fluctuation, their employee counts are generally expected to remain steady as much of aftermarket sales and service are essential and stores need to be located near customers. Similarly, repair shops are unlikely to relocate and are likely to have modest headcount changes as a result of fluctuating service demand.

Side Note 1 - Job Creation Data Collection

The August jobs report is the first one following the dismissal of Bureau of Labor Statistics (BLS) Commissioner Erika McEntarfer. One challenge in reporting job statistics is non-response to employment surveys. This article provides a high-level overview of statistical analysis of survey results to minimize bias resulting from non-response.

As reported in The Wall Street Journal, the response rate for BLS’s monthly survey of 121,000 businesses and government agencies, is about 60% (as noted in this follow-up article, response rate has fallen from an average of 74% from 2010-19 to 57% in August 2025). Responses collected in the following month or two led to revisions. Public schools accounted for much of the revision to May and June payroll numbers, which employed 109,100 fewer people in June than the BLS believed at the time. Late responses from other industries that also skewed negative also contributed to the considerable adjustment. Moreover, concurrent seasonal adjustment amplified the restatement.

Government agencies and large employers are overrepresented among BLS establishment survey participants, which must be taken into account. You may remember when polling ahead of the 2016 U.S. Presidential Election revealed that a small sample of one demographic led to inaccurate extrapolations. This article describes data weighting techniques for polling.

Another challenge is accounting for companies that go out of business and thus have not responded to a survey. I expect such dynamics to be addressed in a longer timescale – as the population of businesses nationwide and the underlying demographics that are the basis of weighting are updated.

Side Note 2 - Bureau of Labor Statistics History

The importance of the non-partisan nature of BLS’s operations has come up in the news. For a history of the BLS’s formation, check out this article.

Welcome to the new YANG Effect! Your one-stop quarterly newsletter for all things Automotive Aftermarket contributed to and written by under-40 industry professionals.

More posts

Market Insights with Mike is a series presented by the Auto Care Association's Director of Market Intelligence, Mike Chung, that is dedicated to analyzing market-influencing trends as they happen and their potential effects on your business and the auto care industry.

More posts