Trade and Tariff Member Survey Highlights

Introduction and context

The ongoing trade and tariff measures have introduced new challenges and uncertainties for the auto care industry, affecting global supply chains, sourcing strategies, and cost structures. Auto Care Association’s International Affairs team surveyed Association members from March 11 to April 1, 2025 to better understand how these policies impact aftermarket businesses and may reshape their operating environment, especially in trade relationships with China, Mexico, and Canada.What did we learn?

• Nearly half of the aftermarket has a negative future outlook due to ongoing trade and tariff measures. Larger companies are generally more optimistic while smaller ones are less confident.• Uncertainty surrounding trade policy and tariffs remains the industry’s most pressing trade challenge (93%) followed by concerns regarding steel and aluminum tariffs (60%).

• A significant part of our industry anticipates increased costs (91%), along with supply chain disruptions and delays in business decision-making.

• Across the board, businesses are increasingly worried about rising costs and weakened competitiveness, particularly in relation to China, due to these tariffs.

• Smaller businesses (<50 employees) are more heavily impacted by tariffs on Chinese imports. Companies attempting to shift sourcing from China face limited alternatives, higher costs, required transition time, and concerns over economic feasibility.

What policies would help?

• Exclude tariffs on parts that are not produced in the U.S. when not economically feasible.

• Establish a comprehensive process for granting exemptions.

• Allow transition periods to adjust supply chains.

Biggest challenge: uncertainty

Figure 1: Biggest trade-related challenges. “Other, please specify” included “other countries retaliating and not buying U.S. products”.

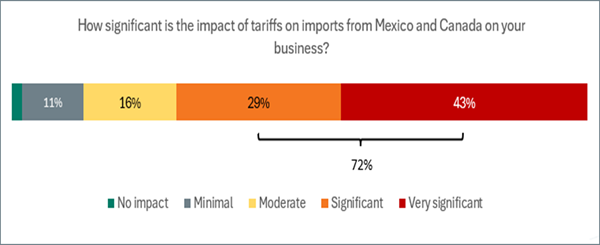

Imports from Mexico and Canada

57% of large companies (500+ employees) describe the impact as “very significant”. Our industry is concerned with a weakened competitive position if tariffs are imposed on Mexico and Canada – one member shared, “Disrupting long standing supply chains in both Canada and Mexico will make us less competitive, especially with China.” Another shared, “If the tariffs are maintained, it will impact sales into and out of both countries which will slow business due to the additional costs.”

Imports from China

Three-quarters of companies report significant impact from tariffs on Chinese imports; this is even more pronounced with small companies (i.e., <50 employees) – 90% of small companies report a significant impact of tariffs on Chinese imports on their business.

Figure 4: Impact of tariffs from China

Aftermarket companies have established operations in China for economic reasons. As illustrated below, while three-quarters have tried to shift sourcing from China to other countries because of tariffs, half could not successfully replace their suppliers while maintaining quality and production capacity (52%), and 40% could only do so partially.

Figure 5: Most companies have tried to shift sourcing away from China, but full replacement is rare

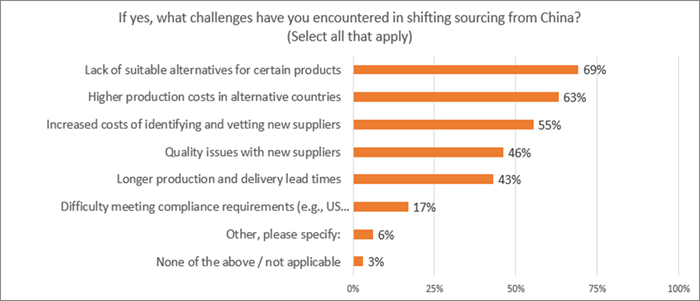

Not surprisingly, limited alternatives and higher production costs hinder sourcing shifts from China:

Figure 6: “There are no real options” for companies that have tried to move sourcing from China

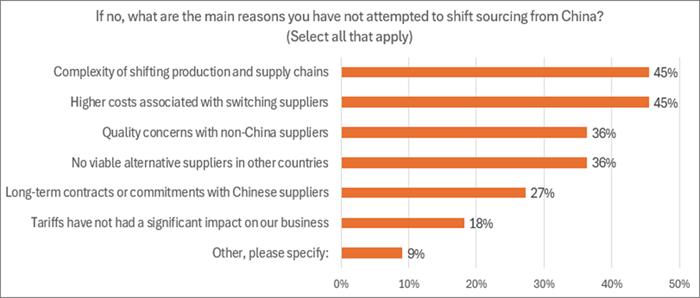

Companies that have not tried to shift sourcing from China point to the complexity of shifting production and supply chains, along with the high costs of changing suppliers:

Figure 7: Complexity, cost, quality concerns, and limited alternatives deter companies from shifting sourcing

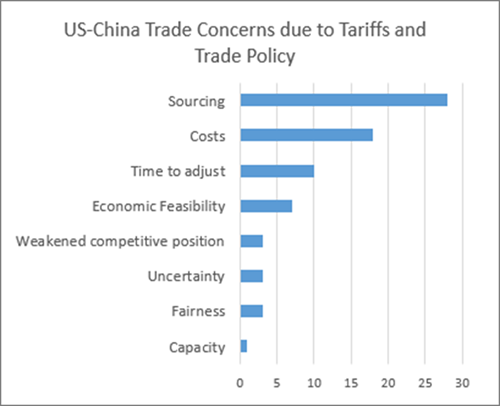

When asked about the role of US-China trade, several members shared insights that speak to the nuances of the industry, as well as challenges that may arise as a result of tariffs:

• “There are numerous automotive aftermarket parts categories that are not cost effective to produce in the US that the industry relies on overseas manufacturing.”

• “Tariffs … increase costs, not just with the goods themselves, but trickling down and across all aspects of the industry … that become an obstacle for purchasing. This may indirectly create counterfeit, black market, incorrect documentation … to keep costs down.”

• “Replacing supply chains that took decades and massive investments to build cannot be completed in the short term.”

Figure 8: What is your perspective on the role of US-China trade in our industry, your business, supply chains and overall global competitiveness? [open-ended question]

Business impacts

• “Country of smelt … % of a specific product [that] is aluminum … not readily available nor easy to obtain for all products. [This causes an] administrative nightmare, creating additional costs and will cost business in the long run.”

• “The costs from adding 10% and 20% and making them effective almost immediately puts a huge burden on our costs. We have no way to mitigate the cost that fast. It takes time to work through our supply chain and customers to implement cost changes.”

• “For customers that are outside of the US, with the additional tariffs, this forces our customers to source elsewhere or even direct which leads to loss of sales and … jobs.”

Member resources

• Provide regular updates on trade and tariff developments that highlight aftermarket-specific impacts. These updates help members stay informed and plan proactively.

• Amplify the collective voice of members through advocacy and lobbying efforts aimed at shaping fair and practical trade policies.

• Host expert-led webinars or workshops to help businesses navigate tariff regulations, sourcing strategies, and compliance requirements.

We’re glad to say that we’ve been doing all of them! For the latest news on tariffs and trade, click here. Members can use Auto Care’s member-exclusive tariff calculator to identify which of the following tariffs may apply cumulatively to your products:

• Section 301 Tariffs on China

• International Emergency Economic Powers Act (IEEPA) Tariffs

• Reciprocal Tariffs

• Section 232 Tariffs on Auto Parts

• Section 232 Tariffs on Steel and Aluminum

Welcome to the new YANG Effect! Your one-stop quarterly newsletter for all things Automotive Aftermarket contributed to and written by under-40 industry professionals.

More posts

Market Insights with Mike is a series presented by the Auto Care Association's Director of Market Intelligence, Mike Chung, that is dedicated to analyzing market-influencing trends as they happen and their potential effects on your business and the auto care industry.

More posts