E-Commerce Trends – Strengthening Sales and Reducing Shrink

As we approach the end-of-year holidays, let’s take a look at what parts categories are selling well in the e-commerce space, and then consider the potential for e-commerce fraud so your company can reduce its risk from this growing problem.

Top Selling E-commerce Category Sales

For the 12 months ending October 14, automotive products accounted for $12.8 billion of sales on Amazon. According to Stackline, “Of 24 product departments, Automotive ranked 13th in terms of sales volume while its 7.5% year-over-year sales growth ranked ninth overall. Products within automotive are relatively highly priced, with an average sales price ranking fifth across all departments.”

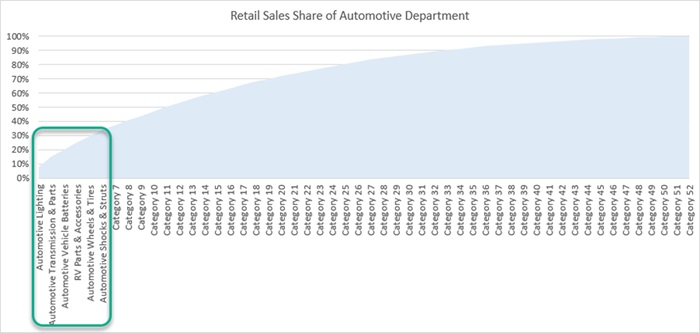

As pictured, the top six parts categories account for one-third of automotive parts sales (33.7%, by dollar value) through Amazon:

1. Automotive Lighting

2. Automotive Transmission & Parts

3. Automotive Vehicle Batteries

4. RV Parts & Accessories

5. Automotive Wheels & Tires

6. Automotive Shocks & Struts

According to Niko Sievers, Director of Strategic Insights at Stackline: “Automotive Lighting was the top category by retail sales within Automotive, generating over $1 billion in retail sales and 8% of Department sales. The top 20 categories (out of 52) generated 72% of retail sales.”

And at the subcategory level, while Automotive Headlights generated the most sales volume, Floor Mats and Shocks/Struts grew the most rapidly at +22%. Other high-growth subcategories include SUV Tires (+56%), All Season Passenger Tires (+46%), and Wiper Blades (+35%).

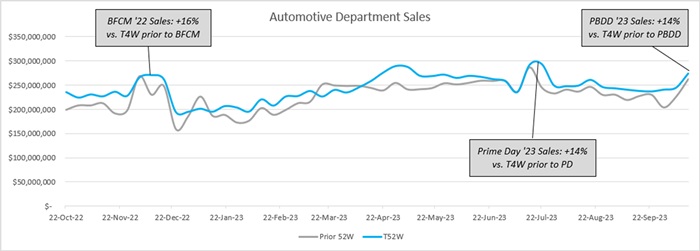

Note: BFCM = "Black Friday Cyber Monday"; T4W = "Trailing 4 Weeks"; PD = "Prime Day"; PBDD = "Prime Big Deal Day"

Source: Stackline, October 2023.

Looking at individual brand performance, Sievers identified Noco as “the top brand across Automotive with its line of jump starters and battery-related products. However, A-Premium generated the strongest growth (+121% year-over-year) of any top brand with a massive increase in promotional activity and ad spend. Noco branded search volume is up 23% year-over-year, with consumers actively seeking out the brand's products across the internet. However, only 6% of searches leading to Noco pages were branded.”

Stackline's Sievers emphasized the growth potential for companies via branded search: “Top search terms within Automotive are nearly entirely unbranded, with only 3% of organic traffic on the top 100 keywords coming via unbranded search. This is a highly competitive product set with relatively little brand loyalty within the online marketplace.”

Retail Shrinkage Trends

There is good reason to be concerned: NRF estimates total shrink at $112 billion for U.S. retailers across all sectors – this “includes losses caused by both internal and external theft, operational or process mistakes and systemic errors” as defined by NRF.

E-commerce Return Rates

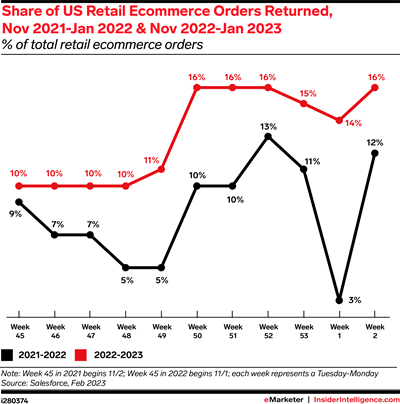

With the holiday season right around the corner, the stakes are high. According to eMarketer, e-commerce return volume has exceeded $200 billion annually since 2021, with 10-16% of U.S. retail e-commerce orders returned from November 2022 to January 2023. The cost to businesses goes beyond processing, restocking, and customer service – 10% of claims and appeasements are expected to be fraudulent.

Source: "Ecommerce return rates rose in retail’s longest holiday season yet", eMarketer, March 2023.Appriss reported “Retailers spent nearly $4.2 billion last year on fraudulent and abusive order claims and appeasements” and recommends verifying that companies’ “fraud detection tools effectively link transaction identifiers across both online and in-store orders to expose consumers trying to conceal their identities.”

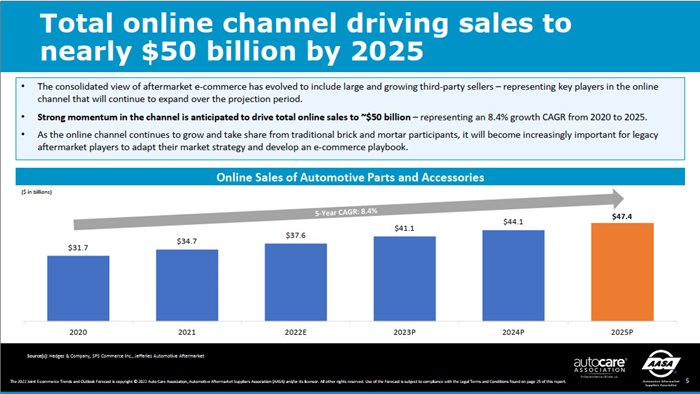

Aftermarket Applicability

Source: 2022 Joint E-commerce Trends and Outlook Forecast (available here.)

What are companies doing about e-commerce fraud?

NRF recommends a number of actions to reduce fraud, including:

• Reviewing line voids, refunds, and seasonal employee discounts every 30 to 90 days.

• Monitoring employee purchases and tallying unique payment cards to estimate the number of employees benefiting from discounts.

With more than $936 billion in holiday sales in 2023, the possibilities of return fraud are significant: “For every $1 billion in sales, the average retailer incurs $165 million in merchandise returns” (https://blog.apprissretail.com/blog/handle-post-holiday-returns-with-care-top-strategies-to-limit-losses), so a healthy portion of that is likely fraudulent.

Addressing aftermarket fraud

To address e-commerce fraud, a number of systems need to be designed and implemented, especially given the number of possibilities – for instance, if you order a part from a parts store online, are you able to return it to a brick-and-mortar store? If you return a part, are there limits on how many parts you can return in a given time period?

We’ll explore this topic in more depth in a future article. Until then, best wishes to you and your families and loved ones for a wonderful Thanksgiving holiday!

Welcome to the new YANG Effect! Your one-stop quarterly newsletter for all things Automotive Aftermarket contributed to and written by under-40 industry professionals.

More posts

Market Insights with Mike is a series presented by the Auto Care Association's Director of Market Intelligence, Mike Chung, that is dedicated to analyzing market-influencing trends as they happen and their potential effects on your business and the auto care industry.

More posts