COVID-19 Disrupting Supply Chains for Half of Auto Care Industry; Legal Considerations for Operations

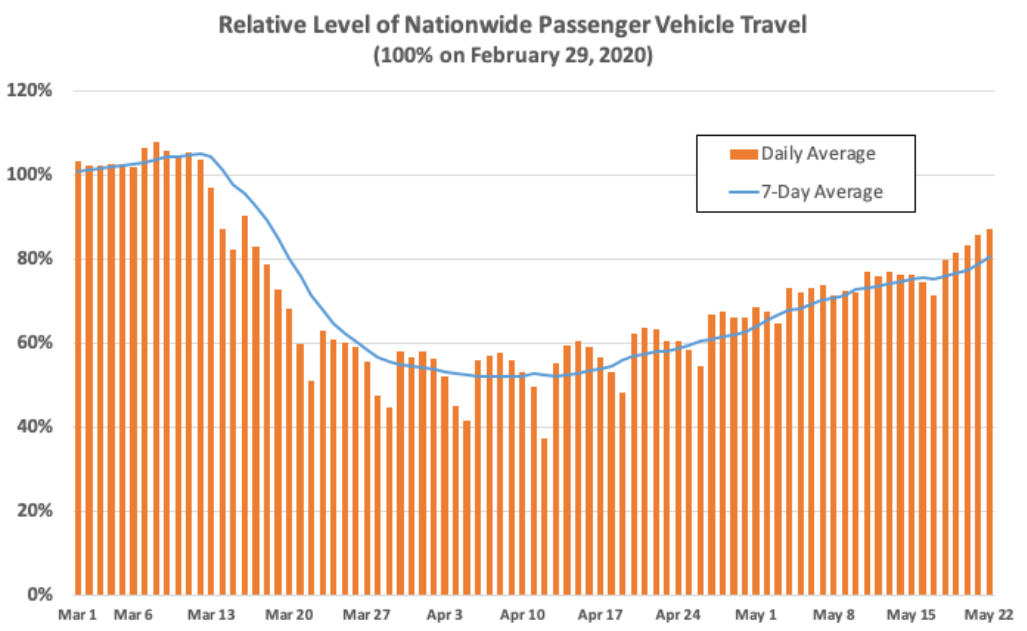

Since the onset of the pandemic and stay-at-home orders, one question hanging

over the industry and the economy has been, “Where is the bottom?” Over the

past few weeks, it appears that the lowest level of vehicle activity is behind

us. As charted below, vehicle travel has steadily crept back up:

Source: INRIX (https://inrix.com/blog/2020/05/covid19-us-traffic-volume-synopsis-10/)

Source: INRIX (https://inrix.com/blog/2020/05/covid19-us-traffic-volume-synopsis-10/)

As we start to see indicators trend upward again, it’s time to start planning for the “new normal” of the next several months and the future ahead. This edition of Market Insights with Mike presents updated results on our survey with the aftermarket regarding COVID-19 impact and outlook, followed by legal considerations for the industry. If you’re reading this, please continue to take our survey monthly so that we can continue to monitor and respond to the impact.

Industry Sentiments and Trends

Throughout the past two months, we have been gauging the pandemic’s impact on the industry. Sentiment was predominantly similar on business performance impact and outlook between early April and late April/early May. In this issue, we compare some differences between small (1-500 employees) and medium/large businesses (501+ employees), and between organization types. We also compare these trends to related industries – manufacturing and wholesale & trade.

Through May 18, we received 208 completed responses to our survey, broken out as follows:

On the whole, two-thirds of aftermarket companies are seeing demand reductions in excess of 10%:

As such, one-third of companies are highly concerned about their cash position – while the sample size is small, this is particularly pronounced with service and repair shops. This is not terribly surprising given consumers’ hesitancy to take their vehicles in for service, in combination with reduction in driving activity.

Interestingly, larger companies are more likely to have reduced staff and/or to have closed a facility:

Upon reflection, several factors may be at play: smaller companies are more likely to be family-owned, and the decision to lay off staff may be more difficult because of close or family relations. Further, smaller companies may be required to maintain pre-pandemic employment levels to secure government assistance, and larger companies are more likely to be publicly traded, with swifter calls to action to demonstrate fiscal stewardship.

Larger companies’ higher likelihood of closing a facility makes sense as they are more likely to have multiple facilities, and may need to close a facility for disinfection or deep cleaning in the event of an employee testing positive for COVID-19, and/or adjust production schedules based on product demand.

About half of the industry is experiencing disruptions in their supply chain:

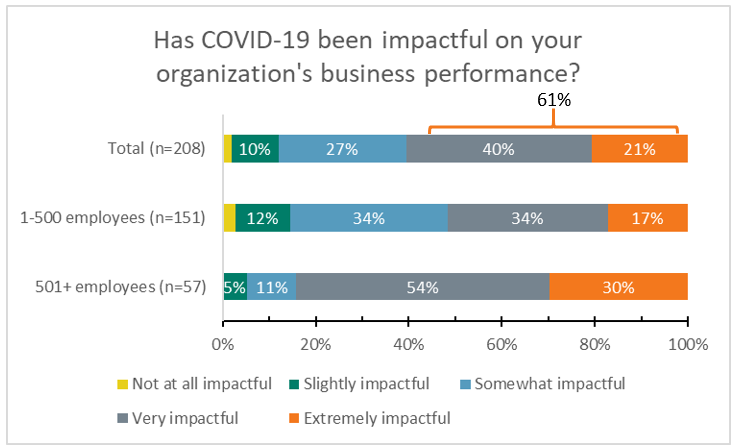

Overall, impacts on business performance and investments have been quite pronounced – nearly two-thirds are experiencing a high level of impact, more so for larger companies:

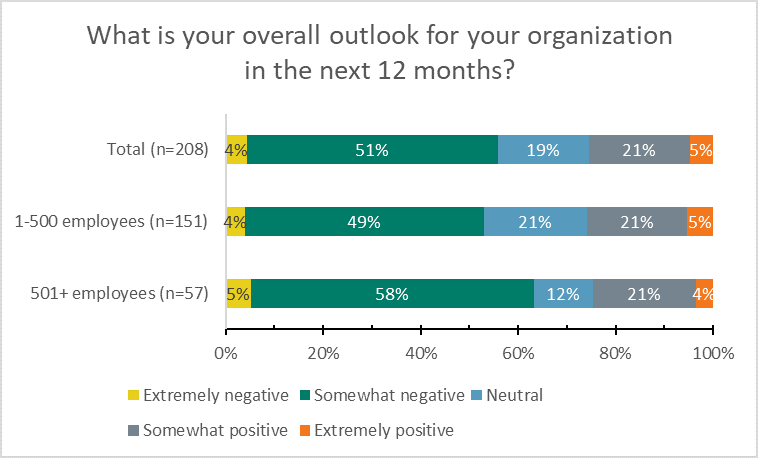

As such, it is not a surprise to see that overall outlook skews negative:

On average, larger companies are slightly more pessimistic, and manufacturing companies even more so: 69% are “extremely negative” (5%) or “somewhat negative” (64%).

Hanover Research reports similar impacts in the Manufacturing and Wholesale & Trade industries: negative impacts include decreases in sales (48%), demand (41%) and productivity (34%), along with supply chain disruption (34%) (Source: Hanover Research , based on survey responses from 58 companies from May 5-9, 2020).

As with the gradual increase in VMT, in Manufacturing and Wholesale & Trade more companies anticipate an increase in their organizations’ topline, while fewer companies anticipate a decrease in the next three months:

Hanover Research, May 2020. “What impact do you anticipate COVID-19 to have on your organization’s topline (i.e., gross sales or revenue) over the next 3 months?” n=40-114 for Manufacturing, Wholesale & Trade.

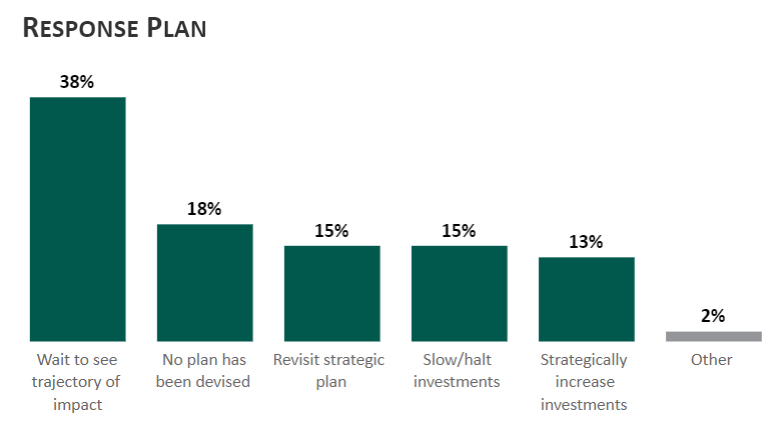

Finally, Hanover finds that companies are largely in a “wait and see” mode in these industries:

Source: Hanover Research. “How does your organization plan to respond to the current and potential impact of COVID-19 on the output or success of the business? Please select the best option.” n=61 for Manufacturing, Wholesale & Trade, 5/5/2020-5/9/2020.

Given the state of uncertainty of further COVID-19 incidence development, government restrictions, and reopening plans, it is not surprising that companies are taking this approach. That one-sixth of companies do not have a plan is unexpected.

Legal Considerations for Auto Care Industry Businesses

As the auto care industry continues to serve customers, many shop and factory owners have contacted their legal counsel on appropriate practices and potential liability. Auto Care’s legal team advises that “While there is no foolproof way to insulate a business from liability, taking reasonable steps and implementing governmental recommendations on social distancing and other preventative measures (PPE, etc.) will enable a business owner to demonstrate reasonableness and social responsibility.”

Shop owners and facility managers should be mindful of adhering to the most stringent applicable laws in considering their duty to provide a healthful and safe workplace for their employees. Beyond the general OSHA requirement to maintain a safe workplace, owners and managers should be cautious to avoid raising issues related to discrimination, leave (paid and unpaid), wage and hour requirements, immigration, whistleblower protection, health and safety recordkeeping and reporting, workers’ compensation, and requirements to post notices related to new laws and regulations.

Social distancing practices that many establishments have implemented include proximity of workers to each other and customers, prohibition of physical contact and sharing equipment, use of personal protective equipment, providence of cleaning/disinfection supplies, staggered scheduling, and limitations on gatherings (e.g., meetings).

Naturally, business owners are concerned with the potential for being held liable in the event a customer claims being infected with COVID-19 as a result of entering the premises of a business establishment. It is worth noting that in some jurisdictions an individual is deemed to “assume the risk” when voluntarily subjecting himself or herself to a known peril – but even in these circumstances the facility owner must take objectively reasonable steps to protect the public. As such, an individual may reasonably be viewed as bearing responsibility with news/media coverage of COVID-19 and related recommendations and orders to avoid unnecessary travel and to practice social distancing.

Another issue is where, when and how was COVID-19 contracted. It will be difficult for customers to prove causation given the nature of the virus and the ongoing inability to pinpoint where and when people have contracted the virus. As stated above, taking reasonable steps and implementing governmental recommendations on social distancing will enable a business owner to demonstrate reasonableness and social responsibility. You are urged to consult with your own legal counsel to obtain advice applicable to your specific circumstances.

Read more Market Insights with Mike here .

Mike Chung is director, market intelligence at Auto Care

Association. With more than a dozen years of experience in market research,

Chung and his team provide the industry with timely information on key factors

and trends influencing the health of the automotive aftermarket and serving as

a critical resource by helping businesses throughout the supply chain to make

better business decisions. Chung has earned several degrees, including a

Bachelor of Science in chemical engineering from Massachusetts Institute of

Technology (MIT), a Master of Science in environmental health management from

Harvard University and a Master of Business Administration with a

concentration in marketing from Montclair State University. Mike can be

reached at

michael.chung@autocare.org.

Mike Chung is director, market intelligence at Auto Care

Association. With more than a dozen years of experience in market research,

Chung and his team provide the industry with timely information on key factors

and trends influencing the health of the automotive aftermarket and serving as

a critical resource by helping businesses throughout the supply chain to make

better business decisions. Chung has earned several degrees, including a

Bachelor of Science in chemical engineering from Massachusetts Institute of

Technology (MIT), a Master of Science in environmental health management from

Harvard University and a Master of Business Administration with a

concentration in marketing from Montclair State University. Mike can be

reached at

michael.chung@autocare.org.

Michael Chung, Director, Market Intelligence

Ready to dive into market research? I provide the industry with timely information on key factors and trends influencing the health of the automotive aftermarket and serving as a critical resource by helping businesses throughout the supply chain to make better business decisions. More About Me

Market Insights with Mike is a series presented by the Auto Care Association's Director of Market Intelligence, Mike Chung, that is dedicated to analyzing market-influencing trends as they happen and their potential effects on your business and the auto care industry.

More posts

Content

-

[WATCH] Driver Behavior Trends and Their Impact on Parts and Service Opportunities

March 17, 2022This webinar analyzes driving behavior at the national, state, and local levels. Gain insights into: consumer behavior; driving patterns; and potential impacts on parts replacement, service and repair scheduling, vehicle age, and the car parc.

-

[WATCH] 2022 Business Outlook: Top Emerging Opportunities and Challenges

February 4, 2022This webinar explores need-to-know emerging opportunities and challenges for the coming year: current status of supply chain issues and what to expect in the year ahead and more.

-

[WATCH] How to Use Vehicle Miles Traveled to Better Your Bottom Line in 2022

December 3, 2021Vehicle Miles Traveled has been respected for years as a key indicator of aftermarket opportunities. Historically, planning has been limited to directional indicators but now aftermarket businesses can leverage more detailed insights on geographic differences as well as vehicle differences to more effectively take advantage of aftermarket opportunities.