On the Road Again

At Auto Care, we’ve talked about appropriate theme songs for our next in-person events. Willie Nelson is a popular choice in our group:

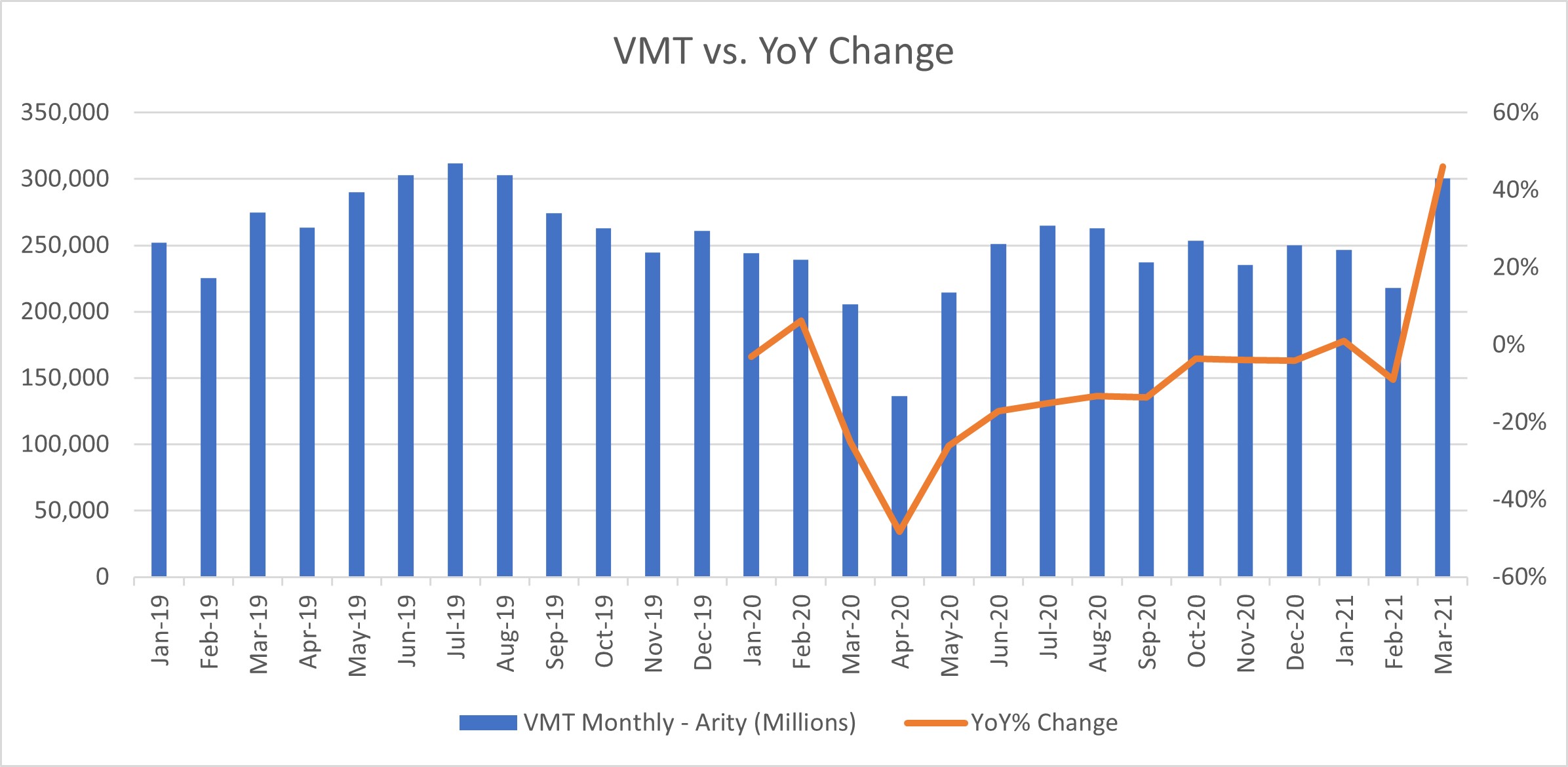

Based on vehicle miles traveled (VMT) for March, the rest of the nation was singing along with Willie as monthly VMT reached its highest level since summer 2019:On the road again

Willie Nelson, “On the Road Again”, copyright Sony/ATV Music Publishing LLC

Just can't wait to get on the road again …

Spring break has broken: the nation hits the road for long-awaited travel

Spring break has broken: the nation hits the road for long-awaited travel– Source: TrendLensTM

This was the first month since August 2019 that VMT exceeded 300 billion miles.

In the Clear?

While this is encouraging for the industry, everyone is anxious and wants to know: when will the pandemic go away? How will the aftermarket perform this year? How bad was it last year?

Before looking to the future, supply chain and materials costs are worth a look. As much as the pandemic has thrown a wrench (sorry, couldn’t resist) into cogs of the aftermarket, the hits just keep on coming.

Microprocessor shortages have confounded new vehicle production. Lead times for microprocessors have been extending across other industries as well, including smart-lighting, as more and more consumer products become “smarter” (whether or not I need a smart dryer is another topic for another forum).

As some raw materials used in microprocessors are scarce, and as much of the infrastructure available to process the materials for use in commercial products (more on this here), this is further compounded by U.S.-China tariffs, more headaches for the Ever Given, increasing port traffic and related disruptions, and even a recent semiconductor facility fire in Japan. As reported, “at least 100 days” is anticipated “for production to normalize at the plant in northeast Japan” (Reuters).

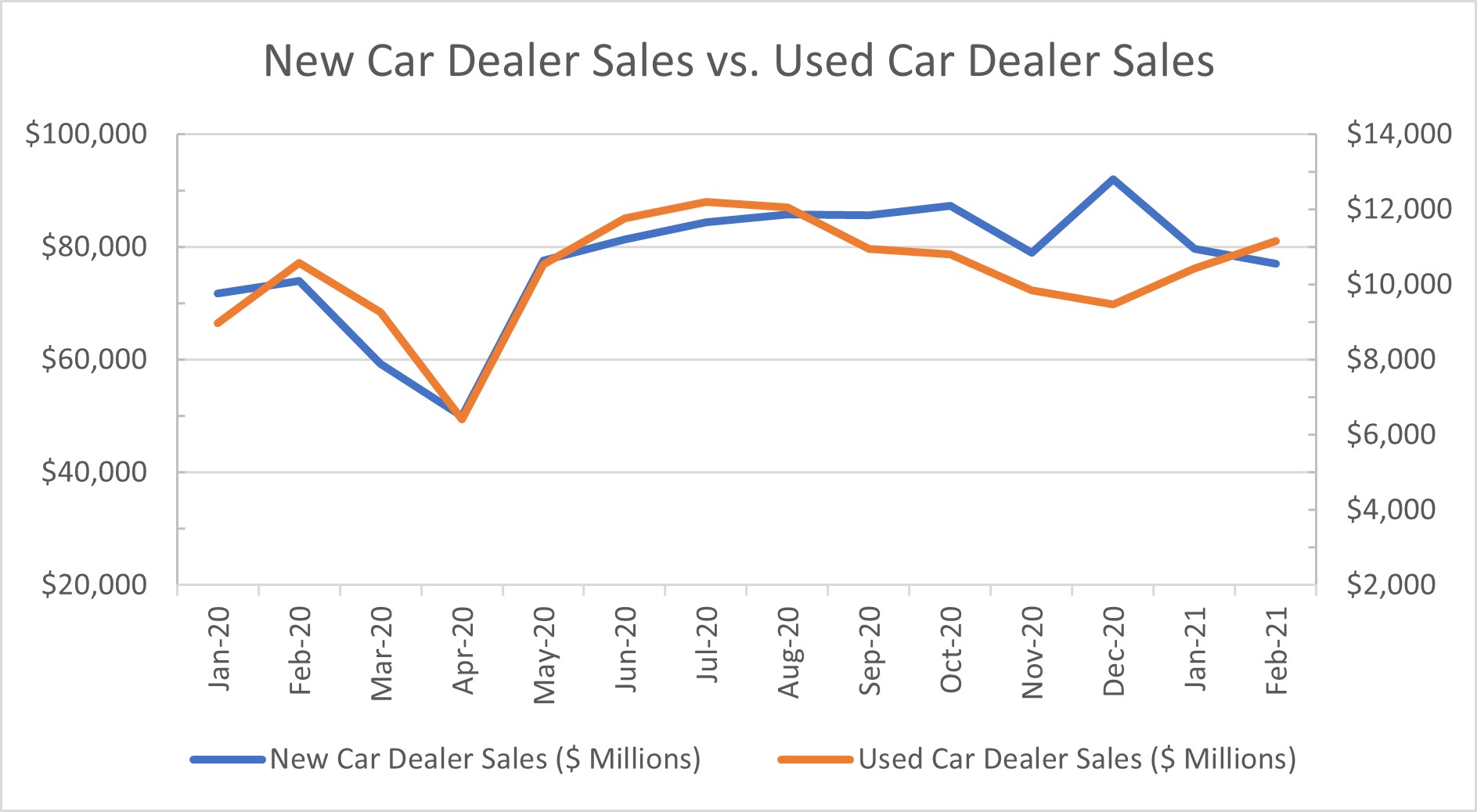

In recent months, we have read of factory shutdowns due to microchip shortages, delaying production of popular vehicles like the Ford F-150, Ram 1500 pickup truck, and Jeep Cherokee (Autoweek). In Spring/Summer 2020, sales of used cars rose dramatically (see figure below) before retreating to pre-pandemic levels through the balance of 2020. This year, used car dealer sales have risen through February, and this trend may continue (note that private sales are not accounted for here), which may contribute to the increasing average age of vehicles.

While new car dealer sales spiked in December 2020, they may decrease further due to microprocessor shortages.

While new car dealer sales spiked in December 2020, they may decrease further due to microprocessor shortages. – Source: TrendLensTM

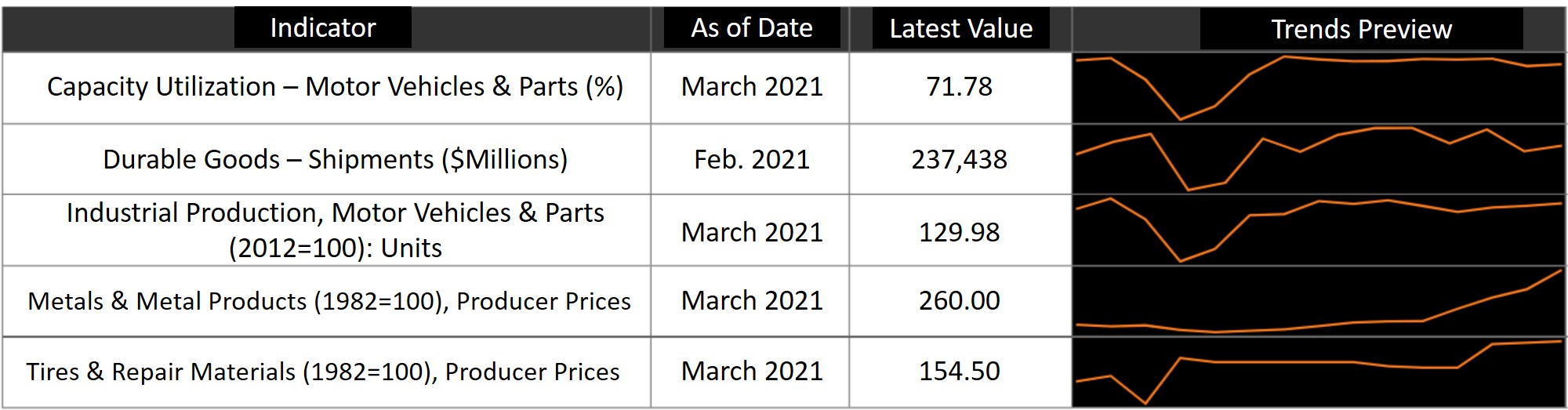

Prices of metals and metal products have risen steadily over the past year. The chart below compares several broader industrial indicators from January 2020 through March 2021 as viewed through the “Trends Comparison” channel of TrendLens™.

Monthly data for selected economic and industry indicators, January 2020 - March 2021.

Monthly data for selected economic and industry indicators, January 2020 - March 2021.– Source: TrendLensTM

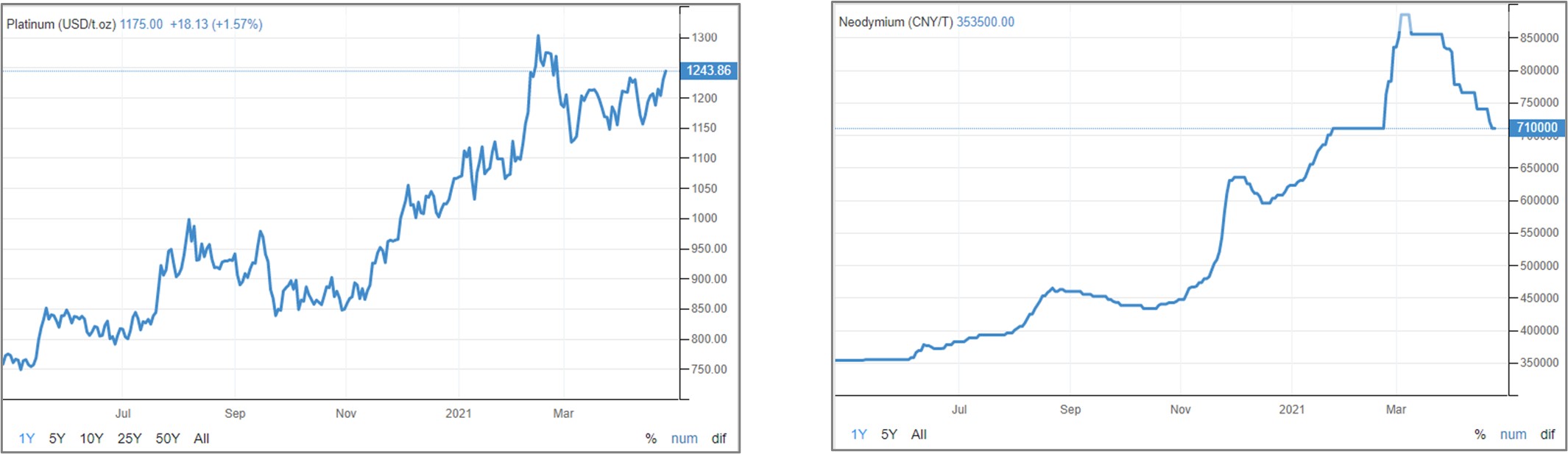

The prices of several industrial elements have risen dramatically throughout the past year. Below are commodity trading prices for platinum and neodymium for the past 12 months.

Platinum (L) and Neodymium (R) trading prices, 12 months through April 25, 2021.

Platinum (L) and Neodymium (R) trading prices, 12 months through April 25, 2021.– Source: Trading Economics

With production delays, as well as the possibility for higher priced new vehicles, we may continue to see elevated demand for used vehicles. As many of these vehicles are likely to be out of warranty, that could bode well for the service side of the aftermarket.

Parting Thoughts

As commuters return to hitting the road, they may look back to last year as the golden era of commuting: as reported by ArsTechnica, "the typical U.S. driver spent 26 hours stuck in traffic in 2020, down from an average of 99 hours in 2019. Only three cities saw an increase in traffic times: Santa Rosa, Calif.; Sarasota, Fla.; and Kaneohe, Hawaii." I’m guessing no one is moving out of Kaneohe because of the traffic.

As travelers get back on planes, rental car prices have jumped higher with the industry facing supply challenges as well. We’ll keep an eye on how rental car companies replenish their inventories and how ride/car-sharing services fare in the meantime.

Michael Chung, Director, Market Intelligence

Ready to dive into market research? I provide the industry with timely information on key factors and trends influencing the health of the automotive aftermarket and serving as a critical resource by helping businesses throughout the supply chain to make better business decisions. More About Me

Market Insights with Mike is a series presented by the Auto Care Association's Director of Market Intelligence, Mike Chung, that is dedicated to analyzing market-influencing trends as they happen and their potential effects on your business and the auto care industry.

More posts

Content

-

[WATCH] Driver Behavior Trends and Their Impact on Parts and Service Opportunities

March 17, 2022This webinar analyzes driving behavior at the national, state, and local levels. Gain insights into: consumer behavior; driving patterns; and potential impacts on parts replacement, service and repair scheduling, vehicle age, and the car parc.

-

[WATCH] 2022 Business Outlook: Top Emerging Opportunities and Challenges

February 4, 2022This webinar explores need-to-know emerging opportunities and challenges for the coming year: current status of supply chain issues and what to expect in the year ahead and more.

-

[WATCH] How to Use Vehicle Miles Traveled to Better Your Bottom Line in 2022

December 3, 2021Vehicle Miles Traveled has been respected for years as a key indicator of aftermarket opportunities. Historically, planning has been limited to directional indicators but now aftermarket businesses can leverage more detailed insights on geographic differences as well as vehicle differences to more effectively take advantage of aftermarket opportunities.