New Industry Indicators Suggest Trend Toward Stability

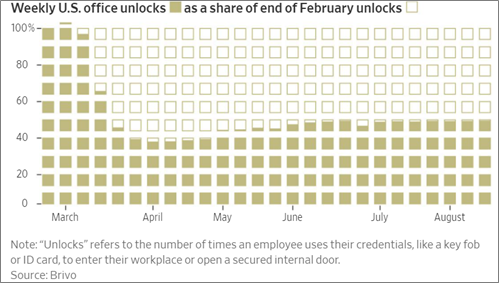

With the nation in the swing of Fall, it appears that some of the things we wondered about in the summer are being resolved, at least for now. Working on site (offices, manufacturing and warehouses, retail) is still at about half of pre-pandemic levels as pictured below.

Source: The Wall Street Journal, Sept. 17, 2020.

As the school year has started, “back to school” has been largely virtual: of the more than 13,000 school districts across the country, 62% are in session virtually, 19% meet in-person, 18% use a hybrid approach, and 1% remains undecided, as of Sept. 2, according to Burbio ( https://info.burbio.com/press/).

Industry Statistics

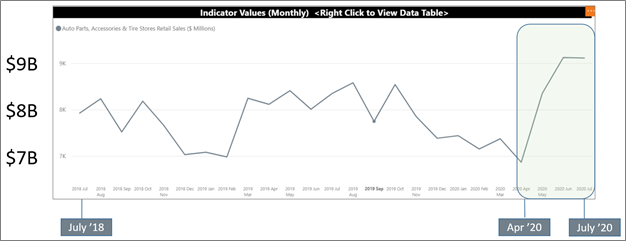

Despite the lower levels of on-site work and in-school instruction, we have

seen some sectors of the aftermarket recover well. As pictured below, retail

sales of automotive parts, accessories, and tires soared in the summer,

reflecting considerable pent-up demand as consumers began driving again and

prepared their vehicles for summer travel.

Source: TrendLens™, Auto Care Association

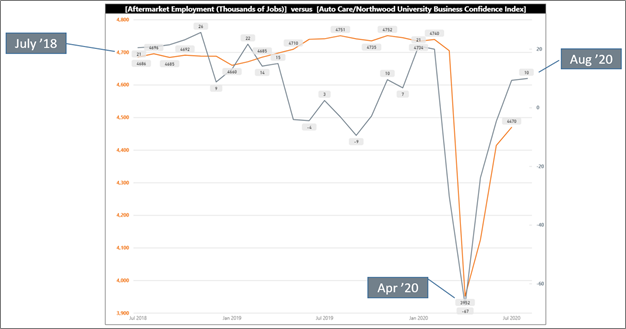

The auto care industry bodes positively – as pictured below, employment and industry sentiment have risen considerably since bottoming out in April:

Source: TrendLens™, Auto Care Association

Will these positive trends continue? There are some indicators that suggest continuation of these trends.

Consumer Sentiment and Behavior

According to IMR Inc. (

AutomotiveResearch.com), while vehicle maintainers remain highly concerned about travelling via

ride share (68.1%) or via public transportation (62.4%) in the context of

COVID-19, they are less concerned about taking their vehicles to a repair shop

for service (32.1%) or shopping- in-store at an auto parts retailer (e.g.,

AutoZone, Advance Auto Parts, O’Reilly Auto Parts) (34.4%).

Perhaps as a result, in addition to spare time and the need for a “project,” Do-It-Yourself (DIY) activity has increased to its highest levels over the summer – 38.2% in July and 43.3% in August – accelerating from 28.9% in 3Q2019, according to weekly surveys of U.S. consumers who are responsible for maintaining their vehicles, conducted by IMR Inc. | ( AutomotiveResearch.com).

Positive Trends for the Aftermarket

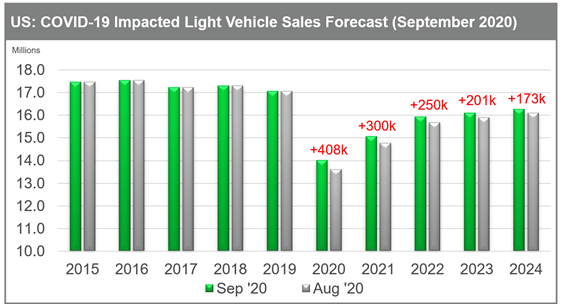

In September, IHS Markit adjusted its 2020 light vehicle sales forecast to be 408,000 units higher than previously modeled in August ( link).

Source: IHS Markit

While sales of new vehicles for 2020 (and beyond) continue to be significantly less than previous years, this bodes well for the aftermarket. The average vehicle age rose to 11.9 years this year, and is likely to continue rising, particularly as owners hold onto their vehicles longer ( link).

Other Considerations

Other uncertainties continue to loom, including the upcoming presidential election, COVID-19 cases, travel restrictions, office and school policies … the list goes on.

We encourage you to “stay tuned” to this column for updated insights, to continue takinge our survey on COVID-19's impact to your aftermarket organization ( click here), and to log in to our TrendLens™ data platform ( trendlens.autocare.org) for access to additional industry data. We are planning webinars and other supplemental materials for navigating the TrendLens™ platform and look forward to providing updates as we create them.

Mike Chung is director, market intelligence at Auto Care

Association. With more than a dozen years of experience in market research,

Chung and his team provide the industry with timely information on key factors

and trends influencing the health of the automotive aftermarket and serving as

a critical resource by helping businesses throughout the supply chain to make

better business decisions. Chung has earned several degrees, including a

Bachelor of Science in chemical engineering from Massachusetts Institute of

Technology (MIT), a Master of Science in environmental health management from

Harvard University and a Master of Business Administration with a

concentration in marketing from Montclair State University. Mike can be

reached at

michael.chung@autocare.org.

Mike Chung is director, market intelligence at Auto Care

Association. With more than a dozen years of experience in market research,

Chung and his team provide the industry with timely information on key factors

and trends influencing the health of the automotive aftermarket and serving as

a critical resource by helping businesses throughout the supply chain to make

better business decisions. Chung has earned several degrees, including a

Bachelor of Science in chemical engineering from Massachusetts Institute of

Technology (MIT), a Master of Science in environmental health management from

Harvard University and a Master of Business Administration with a

concentration in marketing from Montclair State University. Mike can be

reached at

michael.chung@autocare.org.

Michael Chung, Director, Market Intelligence

Ready to dive into market research? I provide the industry with timely information on key factors and trends influencing the health of the automotive aftermarket and serving as a critical resource by helping businesses throughout the supply chain to make better business decisions. More About Me

Market Insights with Mike is a series presented by the Auto Care Association's Director of Market Intelligence, Mike Chung, that is dedicated to analyzing market-influencing trends as they happen and their potential effects on your business and the auto care industry.

More posts

Content

-

[WATCH] Driver Behavior Trends and Their Impact on Parts and Service Opportunities

March 17, 2022This webinar analyzes driving behavior at the national, state, and local levels. Gain insights into: consumer behavior; driving patterns; and potential impacts on parts replacement, service and repair scheduling, vehicle age, and the car parc.

-

[WATCH] 2022 Business Outlook: Top Emerging Opportunities and Challenges

February 4, 2022This webinar explores need-to-know emerging opportunities and challenges for the coming year: current status of supply chain issues and what to expect in the year ahead and more.

-

[WATCH] How to Use Vehicle Miles Traveled to Better Your Bottom Line in 2022

December 3, 2021Vehicle Miles Traveled has been respected for years as a key indicator of aftermarket opportunities. Historically, planning has been limited to directional indicators but now aftermarket businesses can leverage more detailed insights on geographic differences as well as vehicle differences to more effectively take advantage of aftermarket opportunities.