Signs of Another Challenging Spell for the Auto Care Industry and Economy at Large

We at the Auto Care Association hope that you and your families, loved ones,

and colleagues enjoyed the recent holiday weekend and are doing well. This

edition of Market Insights highlights recent trends in vehicle miles

traveled that are encouraging, but perhaps offset by other statistics that

loom as indicators of another rough patch for the U.S. economy and the

aftermarket.

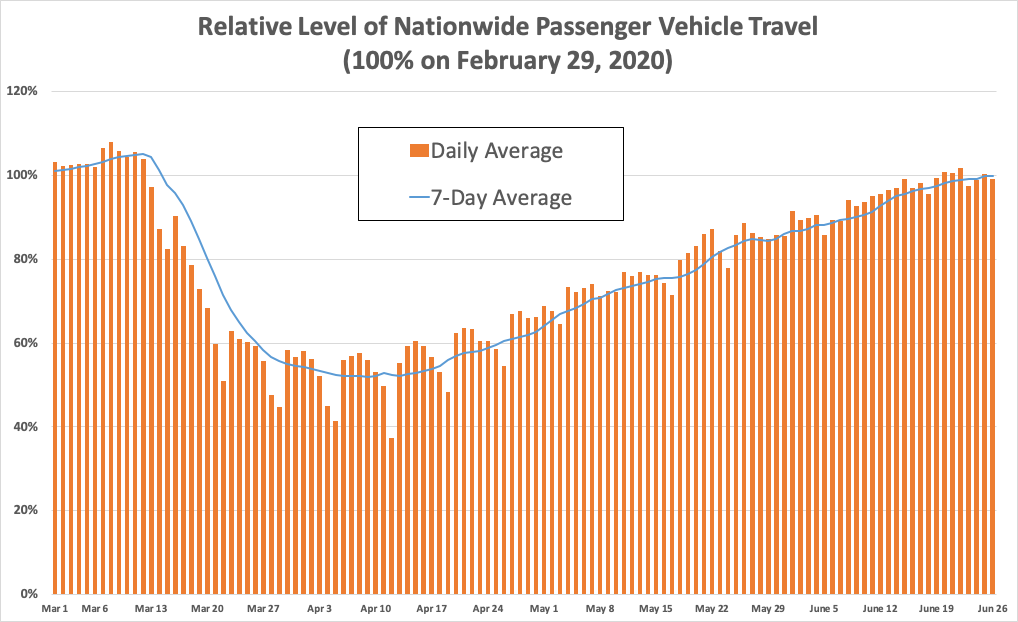

Good News – Mileage is Back to Pre-Pandemic Levels

As of late June, vehicle travel has steadily ascended to pre-pandemic levels – since mid-April, passenger vehicle travel has gradually climbed back up to “normal” levels as states and municipalities have re-opened.

Source: INRIX (https://inrix.com/blog/2020/06/covid19-us-traffic-volume-synopsis-15/)

Source: INRIX (https://inrix.com/blog/2020/06/covid19-us-traffic-volume-synopsis-15/)

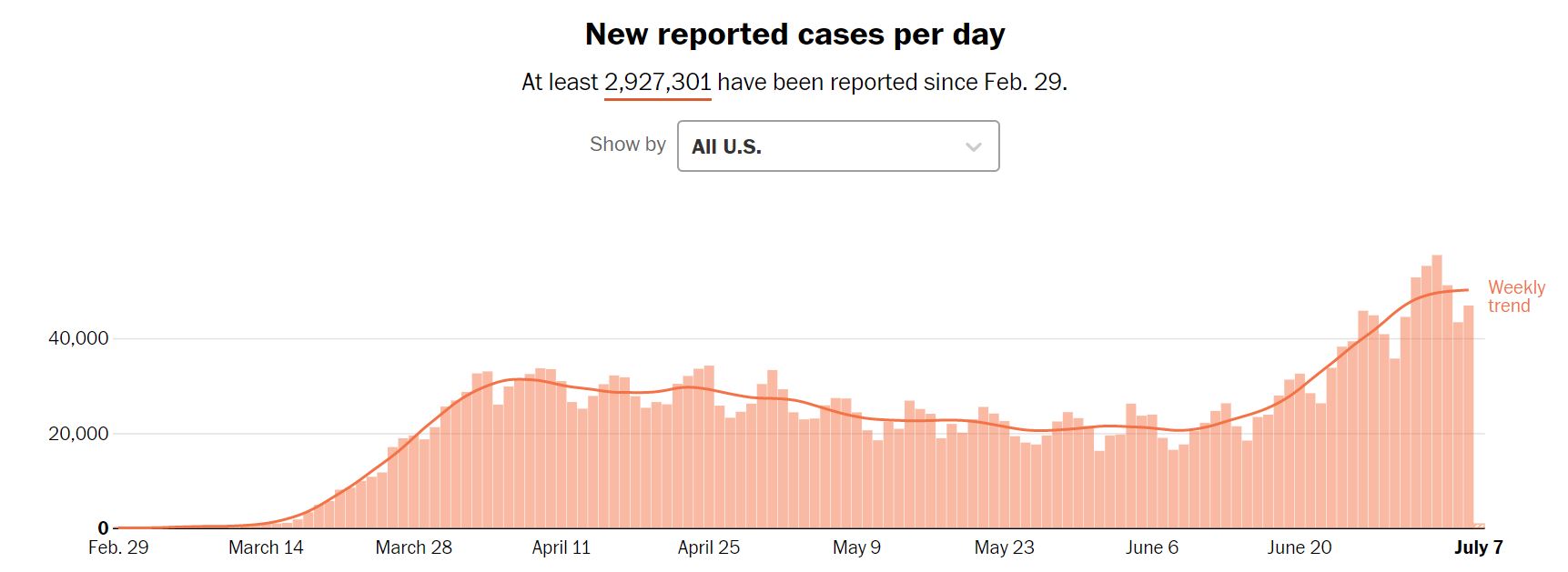

Not-So-Good News – COVID-19 Incidence Rising

After flattening from April to early June, COVID-19 incidence has risen in recent weeks:

Source: The Washington Post, July 7, 2020 (https://www.washingtonpost.com/graphics/2020/national/coronavirus-us-cases-deaths/?itid=hp_no-name_hp-in-the-news%3Apage%2Fin-the-news)

Source: The Washington Post, July 7, 2020 (https://www.washingtonpost.com/graphics/2020/national/coronavirus-us-cases-deaths/?itid=hp_no-name_hp-in-the-news%3Apage%2Fin-the-news)

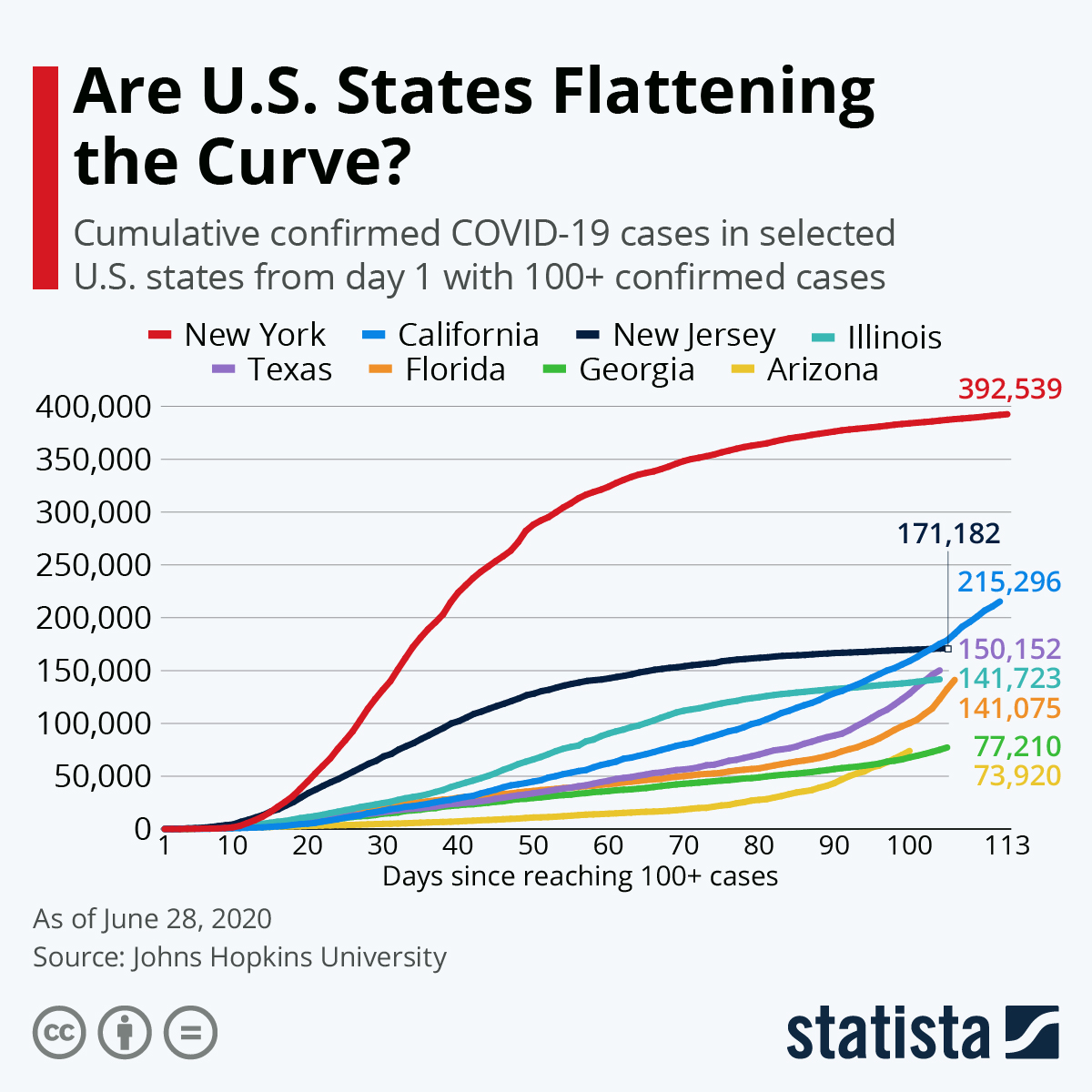

As charted below, cases have been growing rapidly in the West and South, in particular California, Texas, Florida, Georgia and Arizona.

Source: Statista, “Are U.S. States Flattening the Curve?”, by Katharina

Buchholz. June 29, 2020

Source: Statista, “Are U.S. States Flattening the Curve?”, by Katharina

Buchholz. June 29, 2020

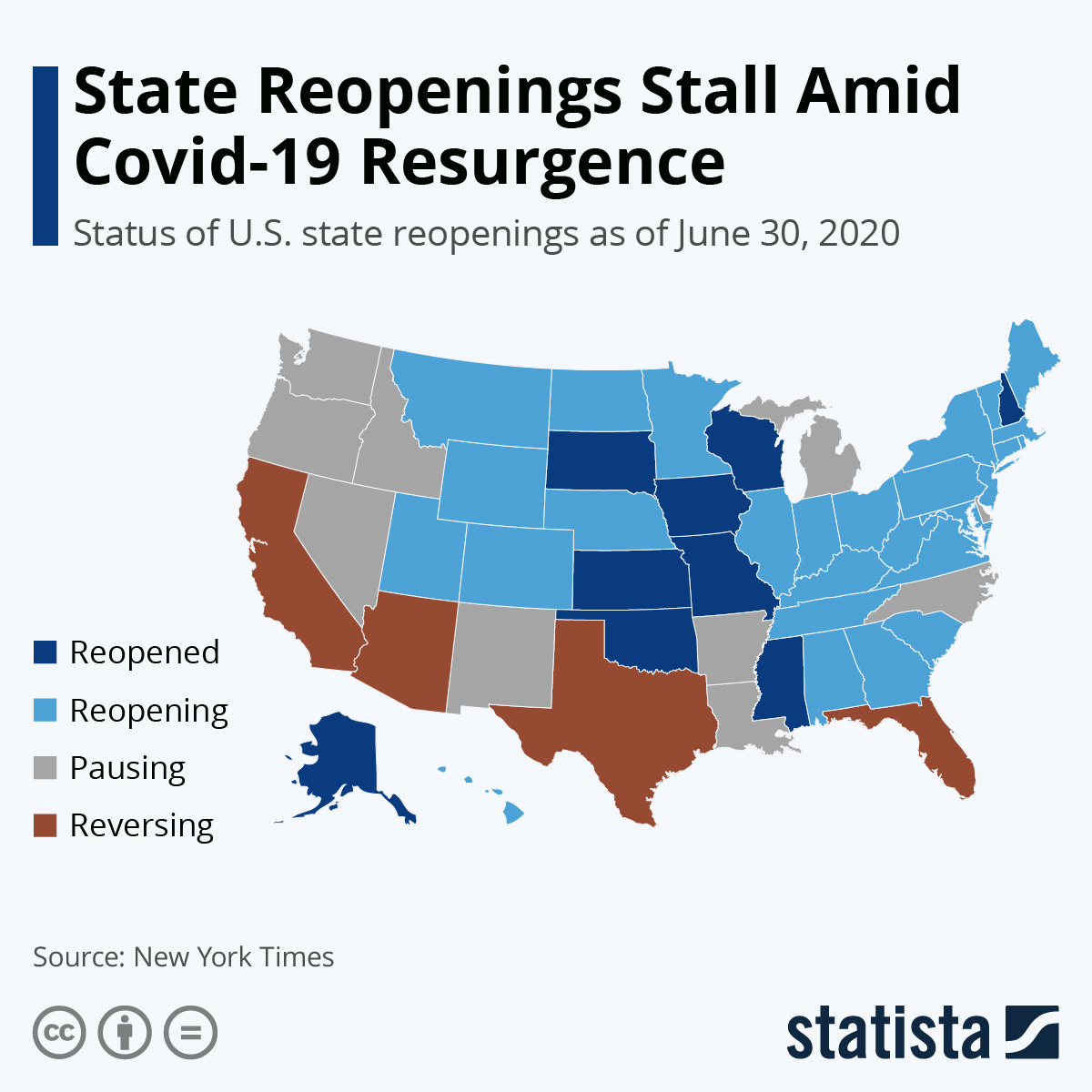

State Reopenings

Based on the changing dynamics of disease spread in each state, several have recently paused their efforts to re-open, or even reversed course to limit activity. For example, Arizona, California, Texas and Florida have scaled back operations for bars, beaches, cafes, nightclubs and gyms in an effort to mitigate disease spread and overburdening healthcare facilities.

Source: Statista, “State Reopenings Stall Amid Covid-19 Resurgence”, by

Niall McCarthy, June 30, 2020 (https://www.statista.com/chart/22155/status-of-us-state-reopenings/)

Source: Statista, “State Reopenings Stall Amid Covid-19 Resurgence”, by

Niall McCarthy, June 30, 2020 (https://www.statista.com/chart/22155/status-of-us-state-reopenings/)

Age Group Considerations

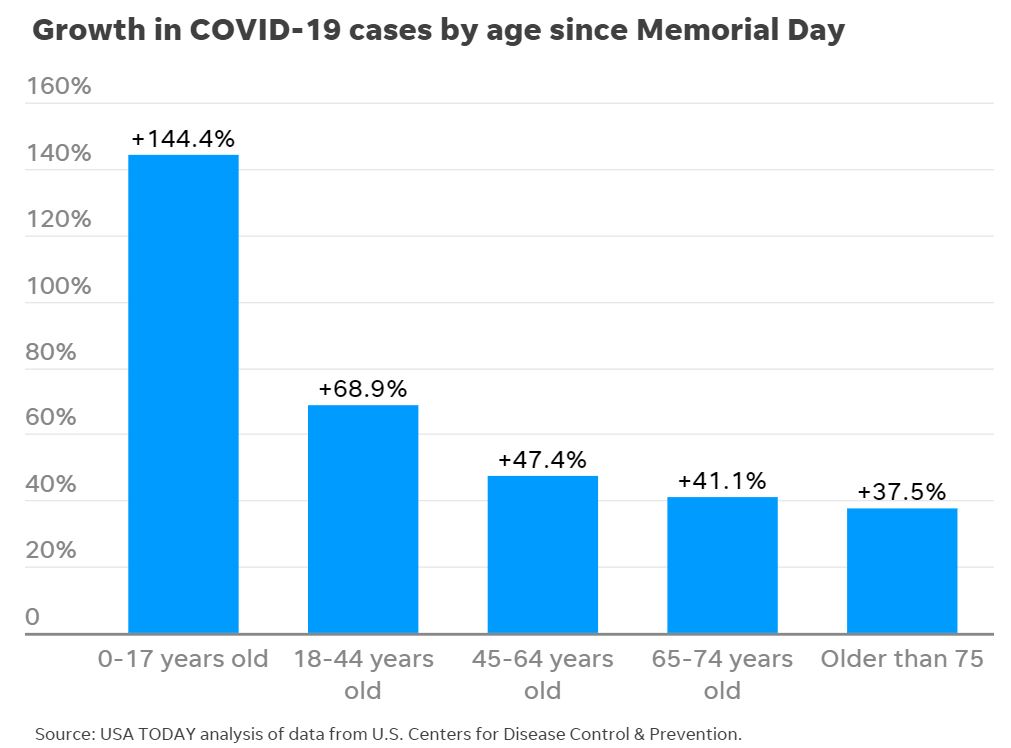

Of concern is the rise in COVID-19 cases in younger generations – as charted below, incidence has increased more rapidly since Memorial Day among those under 45 years old:

Source: “Younger people are a factor in surge of COVID-19 cases, analysis

shows,” by Jayme Fraser, et al. June 26, 2020 (https://www.usatoday.com/story/news/2020/06/26/covid-19-surge-featured-rapid-growth-among-younger-people/3258221001/)

Source: “Younger people are a factor in surge of COVID-19 cases, analysis

shows,” by Jayme Fraser, et al. June 26, 2020 (https://www.usatoday.com/story/news/2020/06/26/covid-19-surge-featured-rapid-growth-among-younger-people/3258221001/)

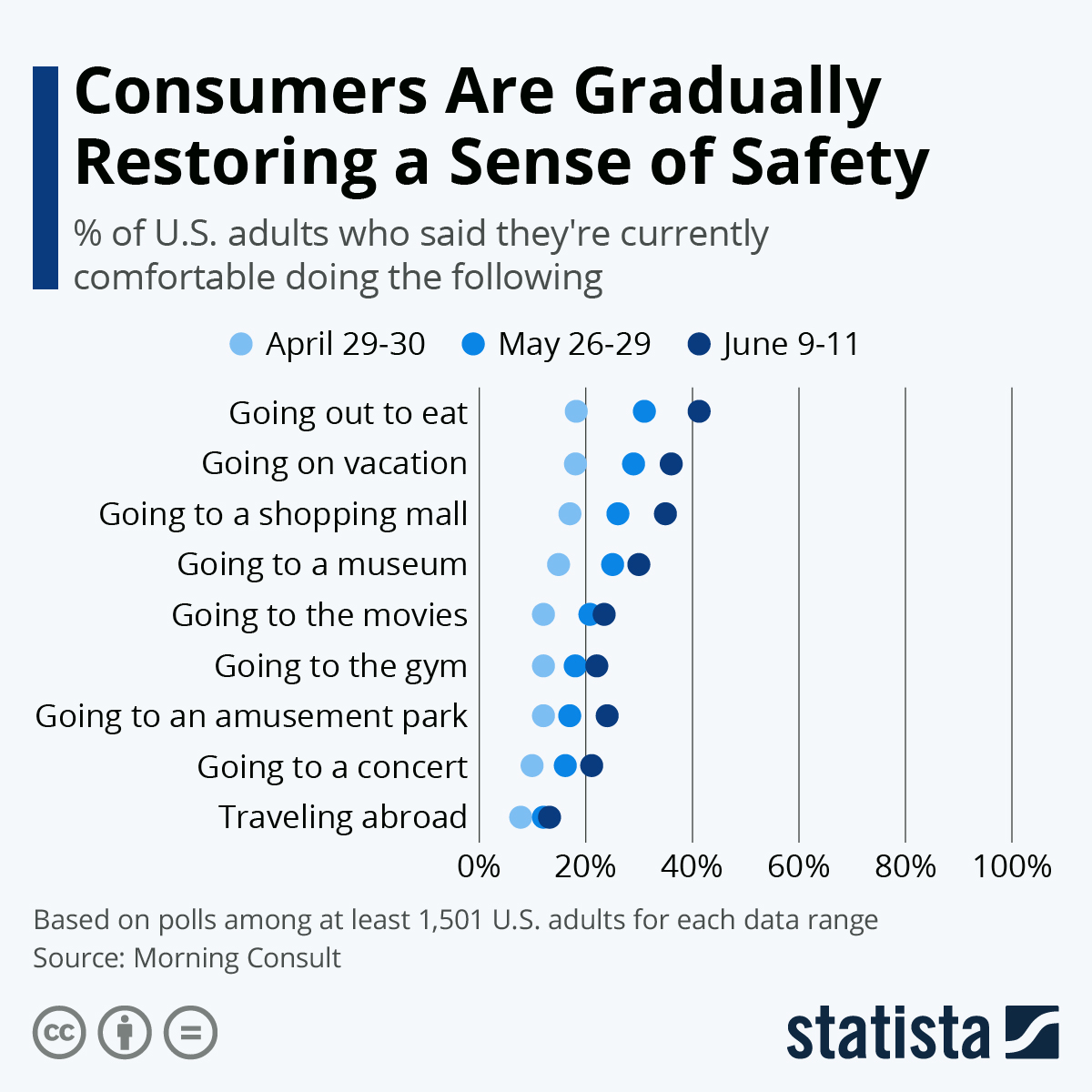

This is of concern as businesses have gradually reopened throughout the summer and as individuals have engaged in more activities outside their home. As the pandemic has progressed, individuals have become gradually more comfortable with engaging in “typical” activities like dining out, traveling for leisure, and going to a shopping mall, but still hesitant to attend movies, work out at a gym, or travel abroad.

Source: “Consumers Are Gradually Restoring a Sense of Safety”, Felix

Richter, June 19, 2020 (https://www.statista.com/chart/22054/readiness-to-return-to-normal-after-coronavirus/)

Source: “Consumers Are Gradually Restoring a Sense of Safety”, Felix

Richter, June 19, 2020 (https://www.statista.com/chart/22054/readiness-to-return-to-normal-after-coronavirus/)

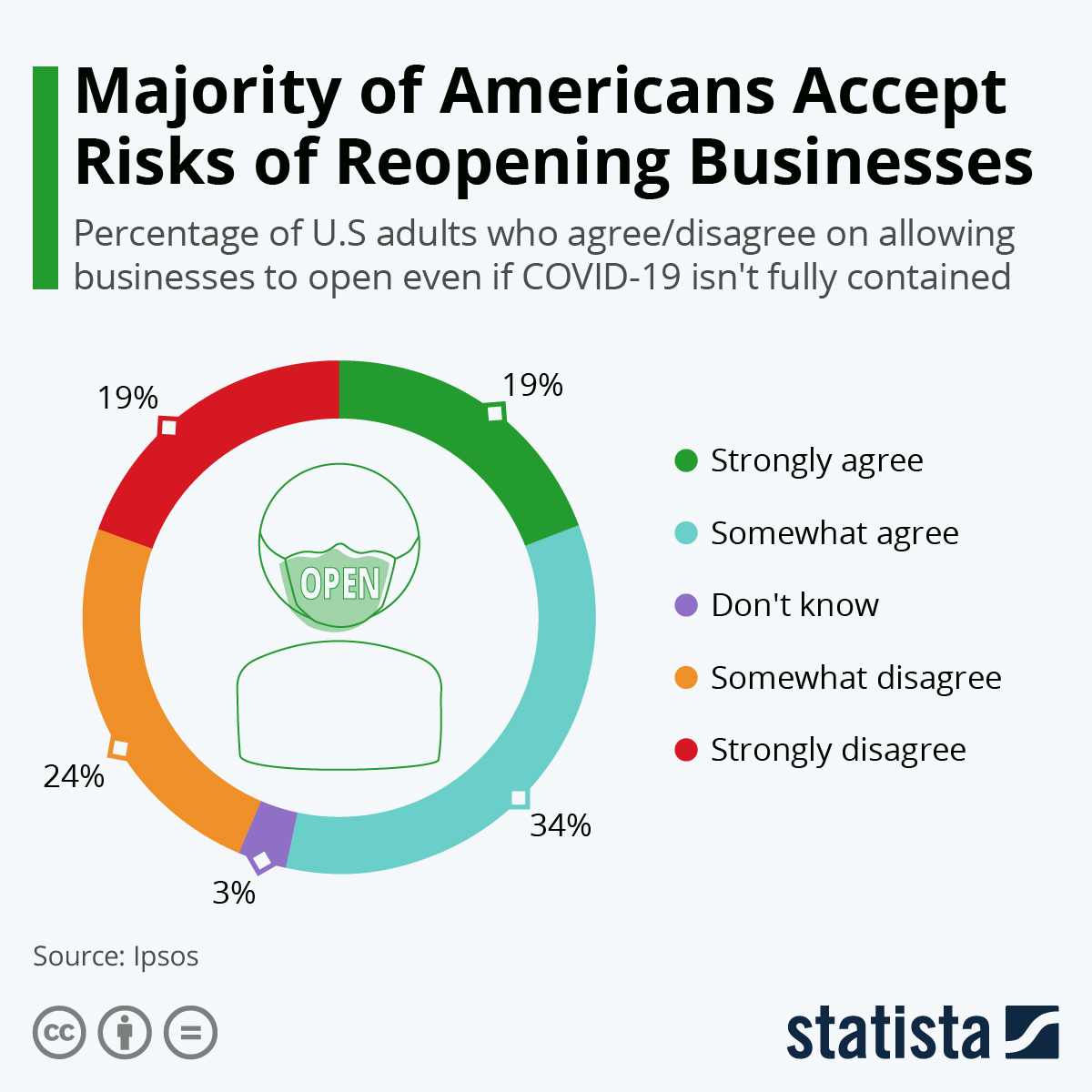

Alongside the public’s willingness to engage in individual activities is the acceptance of risk at an organizational / societal level. Market research firm Ipsos finds that Americans are eager to get back to work despite the continued risks associated with the virus: 53 percent of U.S. adults agree with businesses reopening even if COVID-19 isn’t fully contained, vs. 43 percent who disagree.

Source: “Majority of Americans Accept Risks of Reopening Businesses”,

Willem Roper, June 16, 2020 (https://www.statista.com/chart/22007/americans-reopen-businesses-despite-covid-risks/)

Source: “Majority of Americans Accept Risks of Reopening Businesses”,

Willem Roper, June 16, 2020 (https://www.statista.com/chart/22007/americans-reopen-businesses-despite-covid-risks/)

Industry Considerations

While individuals are gradually venturing out more, the increase in cases, particularly in Southern and Western states, is leading to mandates to restrict business activity. This is likely going to reduce vehicle activity and negatively impact the national economy.

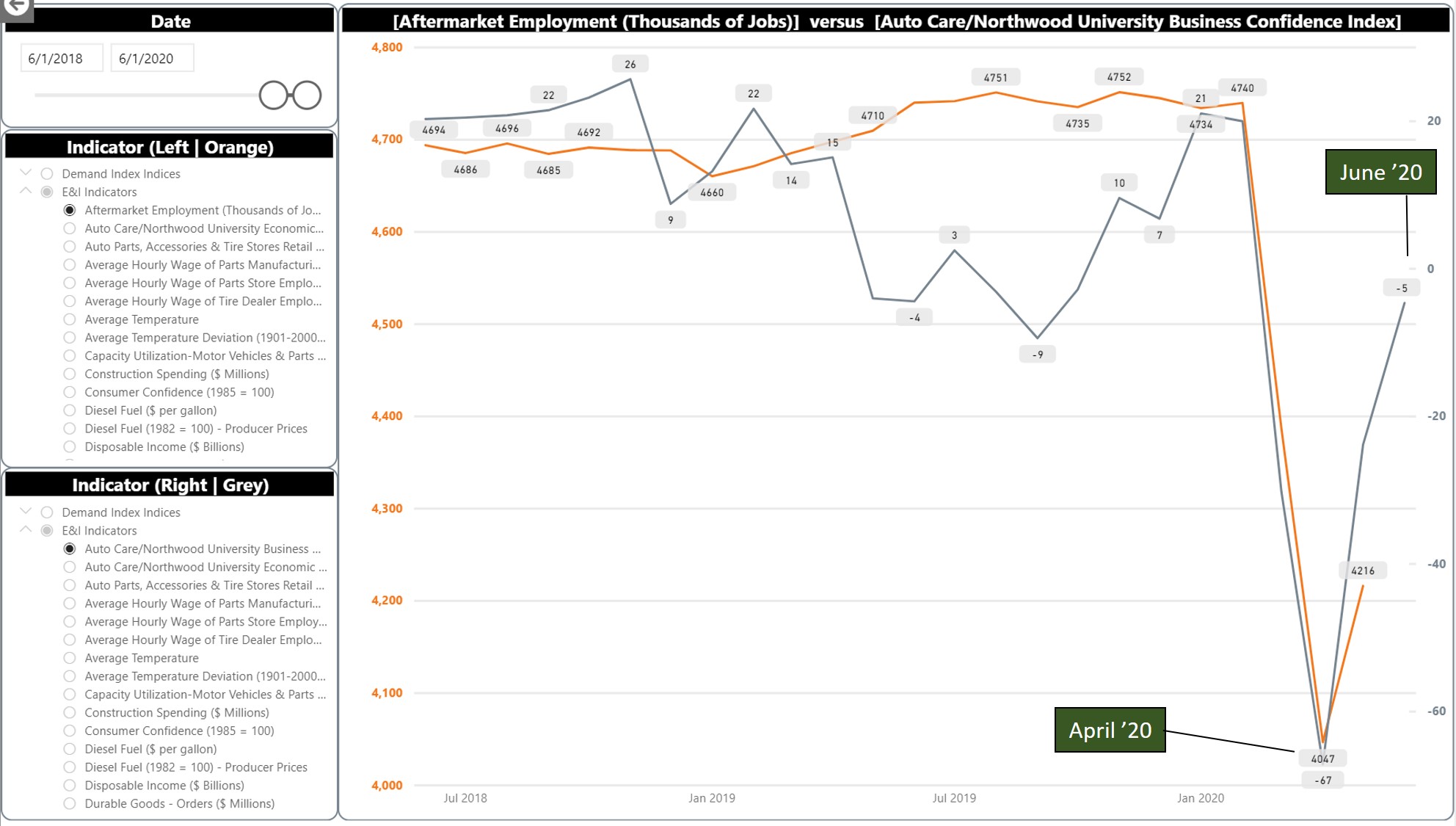

Looking at a few of the industry indicators available in our TrendLens platform, we see that employment and business confidence have both risen since bottoming out in April:

Source: TrendLens, Economic & Industry Indicators, Trend Comparison,

Date Range: 6/1/2018-6/1/2020 (https://trendlens.autocare.org/)

Source: TrendLens, Economic & Industry Indicators, Trend Comparison,

Date Range: 6/1/2018-6/1/2020 (https://trendlens.autocare.org/)

Similarly, we see that capacity utilization and industrial production for motor vehicles and parts fell significantly in April, then began climbing back in May.

Source: TrendLens, Economic & Industry Indicators, Trend Comparison,

Date Range: 6/1/2018-6/1/2020 (https://trendlens.autocare.org/)

Source: TrendLens, Economic & Industry Indicators, Trend Comparison,

Date Range: 6/1/2018-6/1/2020 (https://trendlens.autocare.org/)

With the economic upheaval fresh in our memory, shop owners and businesses have had to sharpen and modify their operations to manage cash flow, personnel, and other vital aspects of their businesses in order to remain operational. Members have shared with us the challenges of staffing appropriately, particularly as business began regaining momentum in May/June.

With the possibility of increased restrictions in areas of the country with rising caseloads, auto industry managers and owners would do well to be prepared for another potential decrease in miles driven and corresponding consumer spend in the aftermarket. As many have done, positioning yourself for PPP loans, engaging your local representative ( click here for resources), and being creative with offering innovative, customer-focused services ( click here to view the recording of our recent webinar to hear more on this topic and a variety of other trends in traditional and e-commerce channels amidst the pandemic) may make the difference between businesses surviving in our “new normal” or being forced to shutter.

We encourage Auto Care members to access the latest economic and industry data via TrendLens so that you can track data most relevant to your organization and plan accordingly.

Global Economy and Industry Forecasts

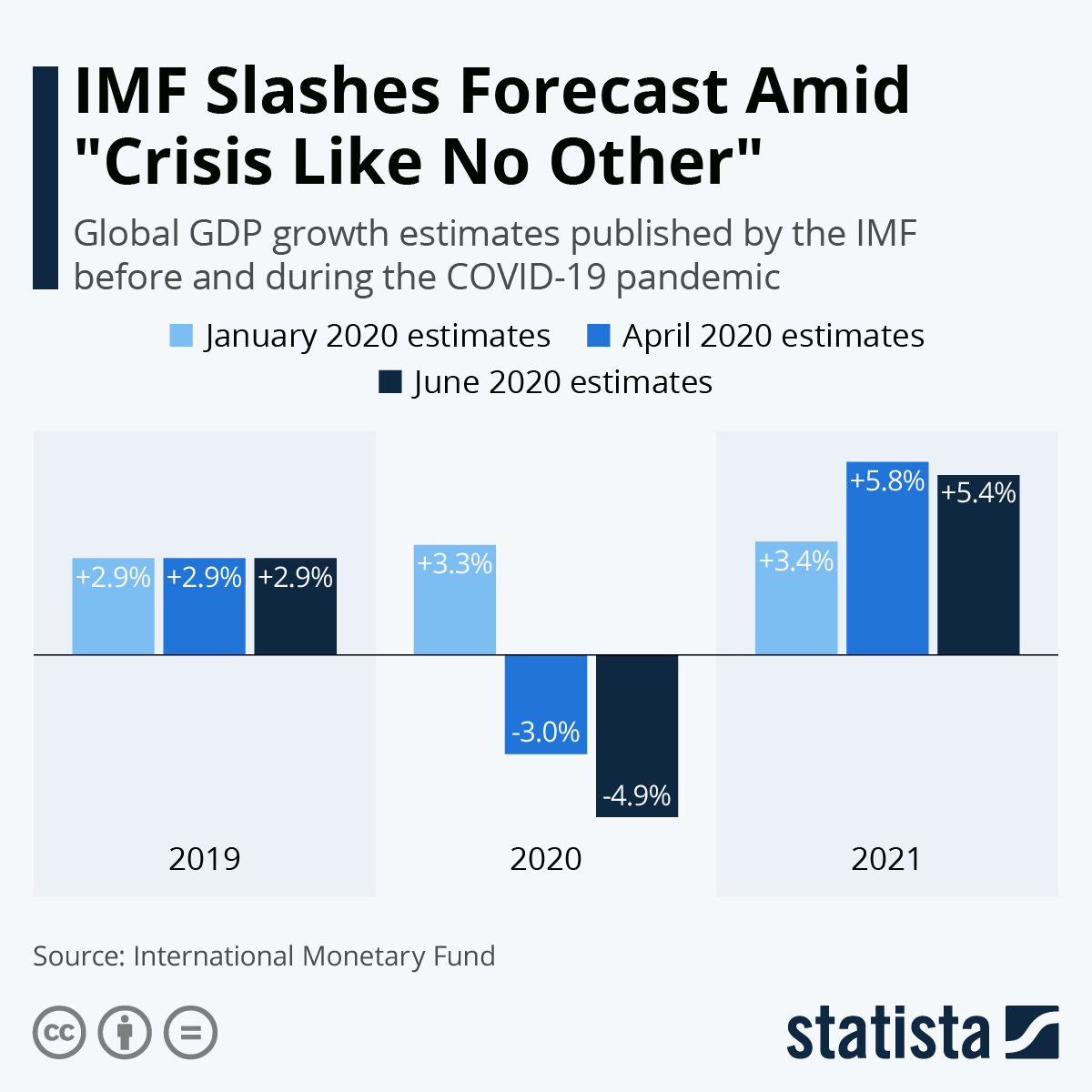

The International Monetary Fund (IMF) cut its global GDP growth forecast for 2020 to -4.9% (previously -3.0% in April) and toned down its optimism for a swift recovery in 2021. The updated estimates would result in a 2021 GDP that is roughly in line with 2019's economic output and 6.5% below pre-COVID-19 projections made in January 2020.

Source: “IMF Slashes Forecast Amid ‘Crisis Like No Other’”, Felix

Richter, June 25, 2020 (https://www.statista.com/chart/21397/global-gdp-growth-forecasts-before-and-during-the-covid-19-pandemic/)

Source: “IMF Slashes Forecast Amid ‘Crisis Like No Other’”, Felix

Richter, June 25, 2020 (https://www.statista.com/chart/21397/global-gdp-growth-forecasts-before-and-during-the-covid-19-pandemic/)

You may be aware of our recent forecast that the U.S. automotive industry is expected to drop 8.8% for 2020, but rebound by 11.7% in 2021 ( click here for press release). As we continue to monitor the industry and economy, we will provide you with updates in current and forecast conditions. Stay tuned, stay safe, and we hope that these columns and resources are helpful for you to navigate the current economy in your segment of the auto care industry and in your particular geography.

Michael Chung, Director, Market Intelligence

Ready to dive into market research? I provide the industry with timely information on key factors and trends influencing the health of the automotive aftermarket and serving as a critical resource by helping businesses throughout the supply chain to make better business decisions. More About Me

Market Insights with Mike is a series presented by the Auto Care Association's Director of Market Intelligence, Mike Chung, that is dedicated to analyzing market-influencing trends as they happen and their potential effects on your business and the auto care industry.

More posts

Content

-

[WATCH] Driver Behavior Trends and Their Impact on Parts and Service Opportunities

March 17, 2022This webinar analyzes driving behavior at the national, state, and local levels. Gain insights into: consumer behavior; driving patterns; and potential impacts on parts replacement, service and repair scheduling, vehicle age, and the car parc.

-

[WATCH] 2022 Business Outlook: Top Emerging Opportunities and Challenges

February 4, 2022This webinar explores need-to-know emerging opportunities and challenges for the coming year: current status of supply chain issues and what to expect in the year ahead and more.

-

[WATCH] How to Use Vehicle Miles Traveled to Better Your Bottom Line in 2022

December 3, 2021Vehicle Miles Traveled has been respected for years as a key indicator of aftermarket opportunities. Historically, planning has been limited to directional indicators but now aftermarket businesses can leverage more detailed insights on geographic differences as well as vehicle differences to more effectively take advantage of aftermarket opportunities.